Tracing Referral Patterns at Long-Term Care Facilities

Share this post

Welcome, visual learners. DHC Visuals is unique feature that enables Definitive Healthcare users to visualize key information when crafting market strategies.

DHC Visuals integrates more than 7 billion all-payer medical claims and other healthcare data into customizable dashboards, including:

- Technology vendor market share

- Financial comparisons

- Quality performance tracker

- Therapy area analytics

- Procedure area analytics, and

- Referral analytics

Definitive Healthcare users can leverage these data families when pinpointing ideal opportunities and points of contact.

Why use Definitive Healthcare’s referral pattern analytics tool?

The referral analytics dashboard uses interactive maps, charts, and tables to visually display physician referral patterns between hospitals and long-term care (LTC) facilities. Examples of these long-term care providers include:

- Skilled nursing facilities (SNFs)

- Hospices, and

- Home health agencies (HHAs)

With this capability, users can segment the data by market, patient volumes, admission rates, and even diagnosis-related group (DRG). Users can also target specific facilities to understand where they refer patients and from whom they receive patients.

In this blog, we use the referral analytics tool to highlight key trends in physician referral patterns between hospitals and long-term care facilities. Through this, we hope to demonstrate how you can use this data to understand long-term care referral patterns and identify high-volume providers.

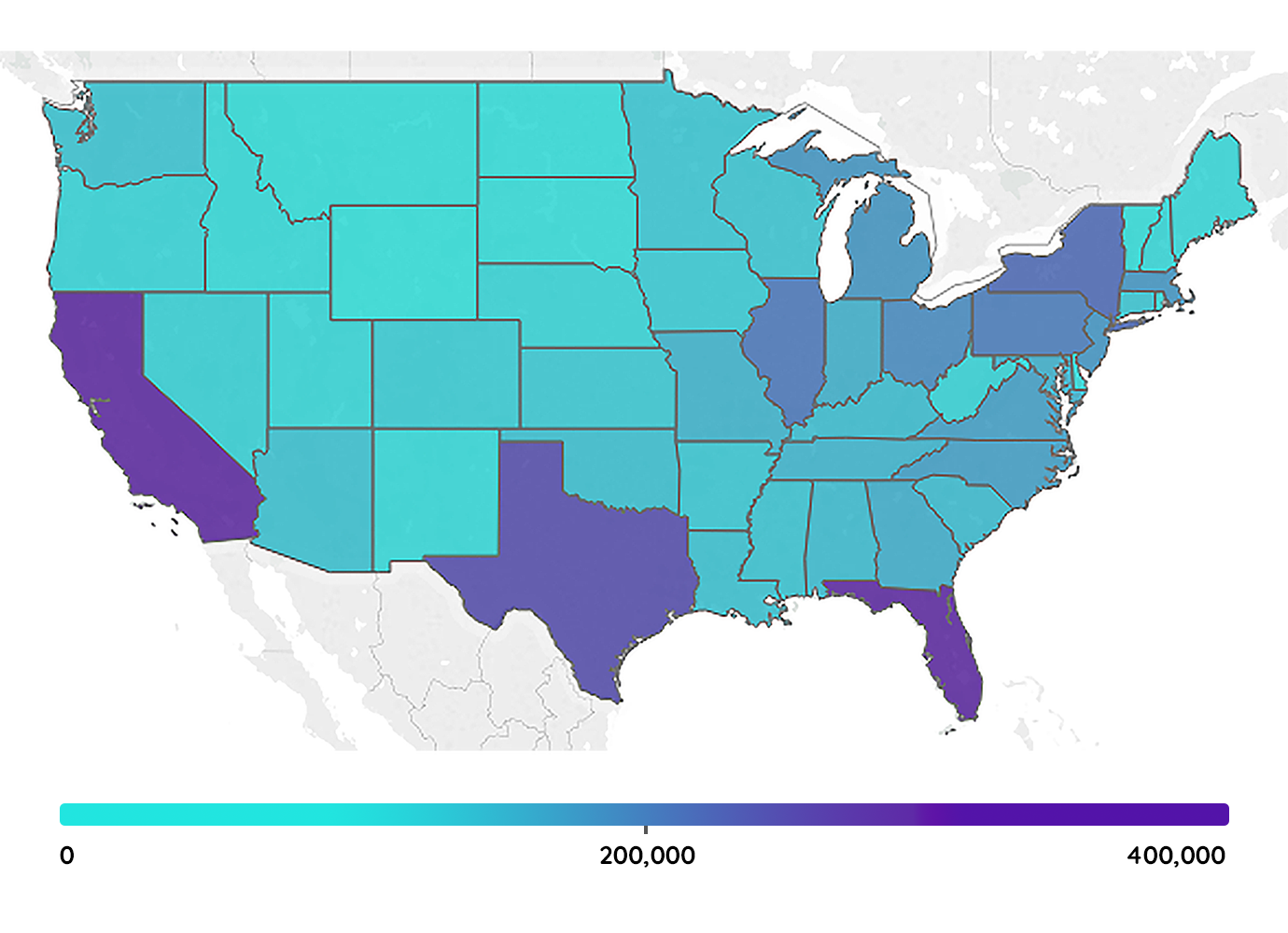

Which states have the most referrals from hospitals?

California, Texas, Florida, and New York had the highest patient referral volumes from hospitals in 2017. These are four of the top five most populous states, so it’s unsurprising that they would report high numbers of patient referrals.

By tracing regions with high referral volumes, users can see areas of growth within the long-term care market. They can also use this information to target high-volume long-term care providers in those areas.

Long-term care referral volumes by state

Fig. 1 Screenshot from the Long-Term Care Referral Analytics dashboard on DHC Visuals. This map represents the state-by-state volume of long-term care referrals for the 2017 claim year. Referral pattern analytics are sourced from Definitive Healthcare’s medical claims database and the 2017 Medicare Standard Analytics File (SAF), the most recent data available. Accessed September 2020.

The table below also shows a correlation between population density and referral volume. All ten of the top hospitals are in or near a large metropolitan area with high patient concentrations. With larger patient populations to care for, these hospitals are referring more patients to long-term care facilities or other specialist provider types.

Top 10 hospitals by long-term care center referrals

| Rank | Definitive ID | Hospital Name | State | Referrals to Long-Term Care Centers |

|---|---|---|---|---|

| 1 | 873 | AdventHealth Orlando | FL |

15,747 |

| 2 | 541974 | NY Presbyterian Weill Cornell Medical Center | NY |

12,166 |

| 3 | 731 | Yale New Haven Hospital | CT |

11,905 |

| 4 | 744 | Christiana Hospital | DE |

11,248 |

| 5 | 1154 | Evanston Hospital | IL |

10,292 |

| 6 | 1973 | Massachusetts General Hospital | MA |

10,239 |

| 7 | 2066 | Beaumont Hospital - Royal Oak | MI |

9,814 |

| 8 | 430 | Cedars-Sinai Medical Center | CA |

9,267 |

| 9 | 1678 | Norton Hospital | KY |

9,179 |

| 10 | 2843 | NYU Langone Tisch Hospital | NY |

8,953 |

Fig. 2 Information about the hospital referrals market is from the long-term care referral analytics dashboard on DHC Visuals. Referral pattern analytics are sourced from Definitive Healthcare’s medical claims database and the 2017 Medicare Standard Analytics File (SAF), the most recent data available. Accessed September 2020.

We might expect hospitals in the southeast to report the most long-term care patient referrals. Florida and other southeastern states have a large percentage of elderly residents. However, many northeastern hospitals report high volumes of long-term care referrals.

Five of the top ten high-referral hospitals are in northeastern states like:

- New York

- Connecticut

- Delaware, and

- Massachusetts

Small northeastern states like Delaware and Connecticut have a higher percentage of elderly residents relative to their population size. Because of this, northeastern hospitals report more long-term care patient referrals than larger states like California, Texas, or Florida.

Which long-term care facilities have the most referrals?

In 2017, skilled nursing facilities and home health agencies had the most referrals from hospitals. It’s worth noting here that DHC Visuals does not include referral pattern analytics for assisted living facilities (ALFs). This is because admittance to assisted living facilities is voluntary and does not need a physician’s referral. While DHC Visuals does not include analytics for assisted living facilities, Definitive Healthcare users can access other data about ALFs on our long-term care database.

The DHC Visuals dashboard allows users to analyze specific hospitals or long-term care facilities for a more in-depth understanding of their referral patterns. The chart below shows the top ten long-term care centers by referrals from hospitals.

Top 10 long-term care facilities by total referrals

| Rank | Definitive ID | Long-Term Care Facility Name | State | Referrals from Hospitals |

|---|---|---|---|---|

| 1 | 789940 | Visiting Nurse Service of NY Home Care | NY |

19,366 |

| 2 | 787273 | Partners Healthcare at Home - Waltham | MA |

10,830 |

| 3 | 790984 | Catholic Health Home Care | NY |

10,564 |

| 4 | 790985 | Northwell Health at Home | NY |

8,519 |

| 5 | 794361 | VNA of Central Jersey Home Care | NJ |

8,329 |

| 6 | 800223 | VITAS Hospice Office - Brevard | FL |

7,649 |

| 7 | 790124 | Advocate Home Health Care Services | IL |

7,488 |

| 8 | 782218 | Beaumont Home Health Services | MI |

6,572 |

| 9 | 794313 | Atlantic Home Care | NJ |

6,495 |

| 10 | 790349 | Metropolitan Jewish Health System Home Care - NY | NY |

5,918 |

Fig. 3 Information about the long-term care referrals market is from the long-term care referral analytics dashboard on DHC Visuals. Referral pattern analytics are sourced from Definitive Healthcare’s medical claims database and the 2017 Medicare Standard Analytics File (SAF), the most recent data available. Accessed September 2020.

Seven of the top ten long-term care facilities by hospital referrals are in the northeastern United States. This trend is unsurprising, especially given that hospitals with the most long-term care center referrals were also located in this region.

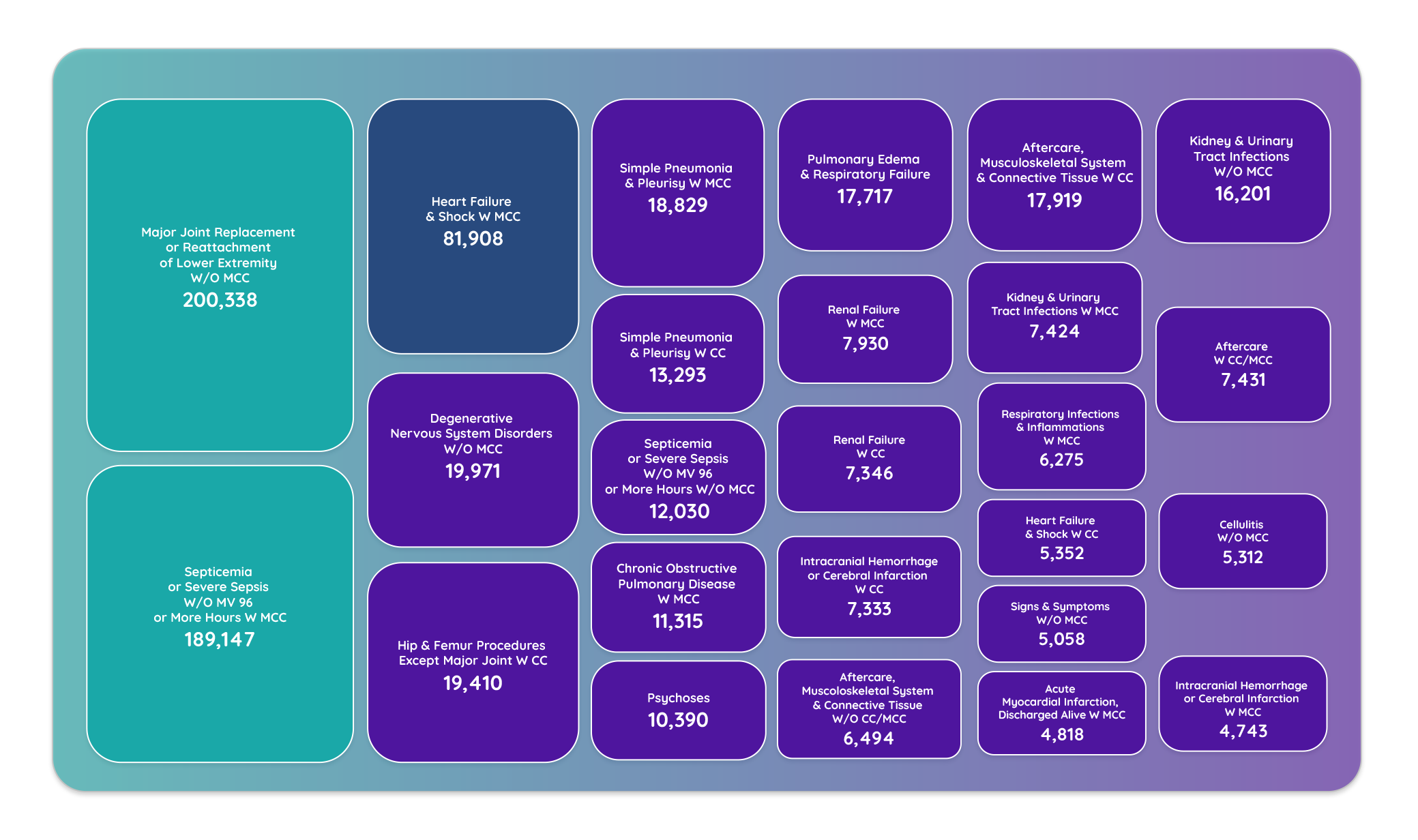

Which diagnoses are most common among long-term care referrals?

In 2017, major joint replacement or reattachment of the lower extremity (DRG 470) was the most common diagnosis among patients referred to long-term care facilities. This code refers to patients who have undergone either a hip or knee replacement. Both are widespread procedures among the elderly patient population.

Top 25 most common diagnoses referred to long-term care centers

Fig. 4 Visual representation of the long-term care referral analytics dashboard on DHC Visuals. This box chart represents the top 25 diagnosis-related groups (DRGs) referred to long-term care facilities in 2017 by patient count. Diagnosis data and referral pattern analytics are sourced from Definitive Healthcare’s medical claims database and the 2017 Medicare Standard Analytics File (SAF), the most recent data available. Accessed September 2020.

Septicemia or severe sepsis (DRG 871) was the second most common diagnosis referred to long-term care facilities in 2017. Sepsis is a blood infection most often caused by pneumonia, urinary tract infections, or other infections. Elderly patients are more at risk for developing sepsis. This risk is due to their weakened immune systems and a higher likelihood of living with chronic medical conditions.

Some of the other most common diagnoses among long-term care referrals include:

- Heart failure

- Pneumonia

- Renal failure

- Psychoses, and

- Degenerative nervous system disorders

Learn More

Are you interested in learning about more ways that you can use the DHC Visuals tool to strengthen your business? Take a look at our blog: Interpreting Medical Claims Data with Visual Analytics.

This blog discusses some of the ways that your organization can use data visualization tools like DHC Visuals to:

- Build a territory plan

- Trace referral patterns

- Identify network leakage, and

- Discover new provider insights

*Originally published October 30, 2019