How to use healthcare reference and affiliation data to grow your business

We partnered with a leading independent research firm to survey leaders at software, information technology, facility services, and medical supply organizations to understand how they use reference and affiliation data and what they need from it. In this report, we explore the results and answer:

- How organizations currently use reference and affiliation data—and which data matters most

- Which factors influence buying decisions most

- What are the challenges that organizations face around data usage

- Why Definitive Healthcare is a top-ranked vendor

Download your copy to learn how healthcare reference and affiliation data can serve as a strategic asset to organizations across the healthcare ecosystem, and why Definitive Healthcare is an ideal partner for implementing it.

Take the next step

Definitive Healthcare is the most comprehensive healthcare commercial intelligence platform, delivering information on every care provider in the U.S.

What’s inside

If you’re trying to find your way around the healthcare landscape, you need real-time, contextual data to uncover and prioritize new opportunities as they develop.

Start browsing the market, and you’ll quickly discover that a multitude of different vendors have a practically endless array of data packages, products, and platforms, all promising to overhaul your strategy and deliver untold success. But how do you know which data you really need? You can start by looking at the data being used by leaders within your segment of the industry.

How do you know which data you really need?

Every day, healthcare leaders use reference and affiliation data to achieve growth and shape impactful strategies in their markets. The healthcare landscape may be changing constantly, but continuously updated reference and affiliation data offers a real-time view of the entities operating within it.

Healthcare reference data is the firmographic, location, and financial data for hospitals and healthcare delivery facilities, as well as the demographic, contact, and location information for healthcare providers.

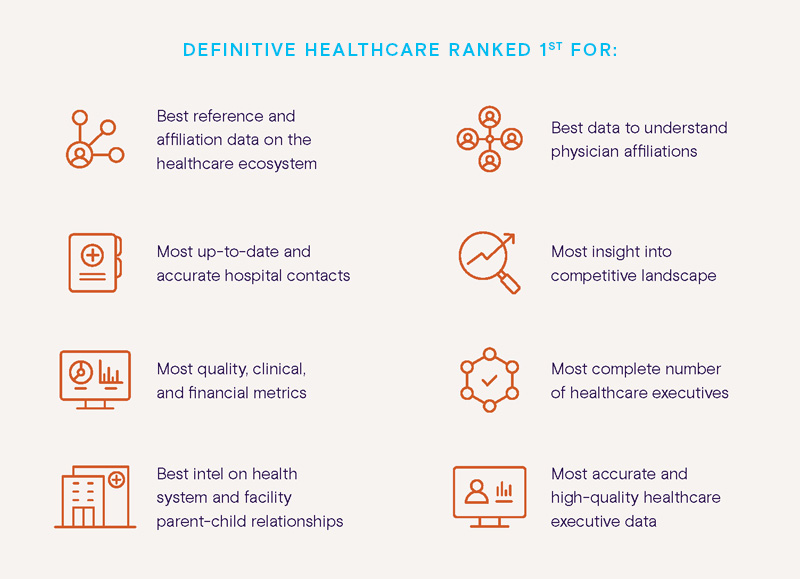

According to an independent market research survey, Definitive Healthcare is the #1 ranked vendor for the top 10 use cases and the #1 ranked vendor for comprehensive healthcare reference and affiliation data used by diversified companies, beating out ZoomInfo, LexisNexis, and IQVIA.

Affiliations data explains how healthcare delivery organizations and providers are connected to each other, looking at the in-depth and complicated relationships among providers, hospitals, physician groups, integrated delivery networks, accountable care organizations, group purchasing organizations, government organizations, and other healthcare networks and systems.

Healthcare reference and affiliation data offers detailed intelligence about the relationships and connections between healthcare providers and healthcare organizations, including:

- Which physicians work at which hospitals

- Which hospitals are affiliated with which ambulatory care centers

- Which billing office manages which integrated delivery network (IDN)

Different organizations leverage reference and affiliation data in their own unique ways, but they’ve all found that this data is essential to competing and winning in the complex healthcare market. To gain insight into how organizations are using reference and affiliation data today—and which vendors they prefer—Definitive Healthcare hired an independent research firm to conduct a survey among “diversified” organizations: software, information technology, facility and financial services, real estate, construction and engineering, and medical supply companies.

In this report, you’ll learn why so many organizations prefer the Atlas Dataset from Definitive Healthcare for reference and affiliation data. In fact, the independent survey found that for each of the top 10 use cases, Definitive Healthcare ranked first among all vendors. The survey also recognized Definitive Healthcare as the most comprehensive vendor for healthcare reference and affiliation data. This report will share more details on those survey results and also cover which types of data are most important for targeting prospects, how organizations prioritize their data requirements, and why hospital affiliations are critical for so many organizations’ go-to-market strategies.

“[Definitive Healthcare is the] easiest database to navigate and find key contacts for targeting.”

—Software & IT marketing c-suite

Key takeaways

An independent third-party research firm found that Definitive Healthcare is a top choice for healthcare reference and affiliation data used by software, information technology, facility services, medical supply companies, and other diversified companies. Here’s what respondents had to say:

- Vendor preferences: Definitive Healthcare is the #1 ranked vendor for the top 10 use cases and the #1 ranked vendor for eight data categories, including the best healthcare reference and affiliation data.

- Major use cases: Most users are leveraging reference and affiliation data to target key decision-makers, optimize sales intelligence, and identify decisionmakers and influencers.

- Importance and types of data: Executive contact information, provider names, and contact information top organizations’ data wish lists

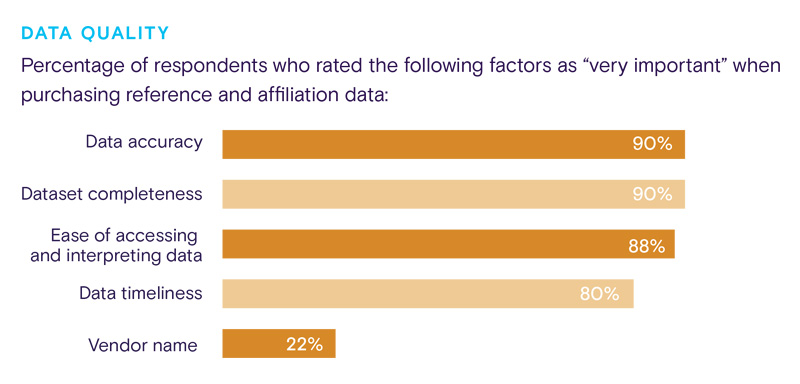

- Buying considerations: Accuracy, completeness, and ease of access are the most important criteria for industry leaders when making a purchase decision.

- Challenges to access: Only 56% of diversified organizations feel strongly that their sales, marketing, and business development teams have the data and insights they need to identify the right prospects.

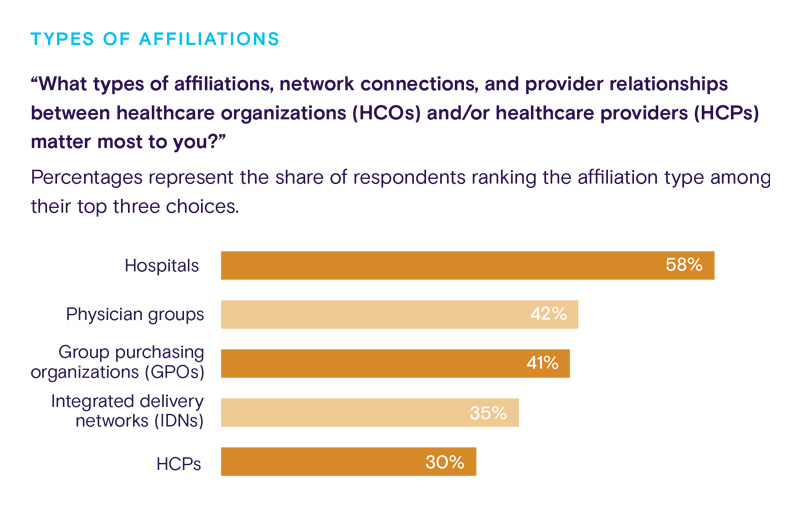

- Most important affiliations: Hospital affiliations matter most to industry leaders.

Major use cases for healthcare reference and affiliation data

Diversified industry leaders have a wide variety of uses for healthcare reference and affiliation data, from identifying and targeting decision-makers and influencers to sizing markets and prioritizing accounts.

For all of the top 10 use cases for healthcare reference and affiliation data, respondents ranked Definitive Healthcare as the #1 vendor, beating out such companies as ZoomInfo, LexisNexis, and IQVIA.

Definitive Healthcare was also recognized as the most comprehensive vendor for healthcare reference and affiliation data based on its top ranking in eight categories:

“Overall, Definitive Healthcare’s combination of comprehensive data, accuracy, functionality, customization, and reputation make them a top choice for organizations looking for reference and affiliation data on the healthcare ecosystem.“

—Software & IT marketing c-suite

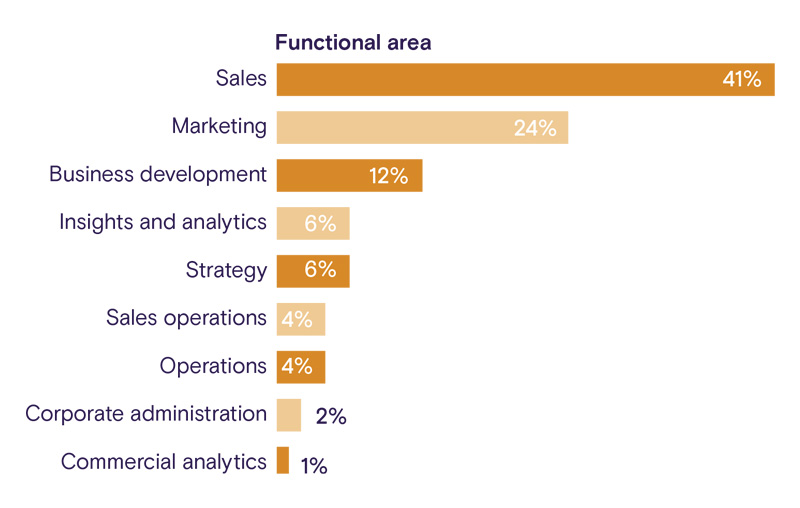

Who uses reference and affiliation data

The survey also examined the teams most likely to leverage healthcare reference and affiliation data and how often they use it. Four in 10 teams say they use reference and affiliation data nearly every day.

Diversified organization teams who use reference and affiliation data

- Sales

- Marketing

- Business development

- Sales operations

- Strategy

- Market research

- Corporate/Executives

- Insights and analytics

- Commercial analytics

- Supply and manufacturing

What organizations say they need from their data

Use cases across a variety of teams require organizations to work with multiple types of data. Healthcare reference and affiliation data contains information from across the industry, including firmographic, geographic, and financial data on hospitals and health facilities, as well as demographic, contact, and quality metrics on healthcare providers. The survey shows that software, information technology, facility services, and medical supply companies especially value these types of data.

“Definitive [Healthcare has] the most comprehensive list of hospitals, leaders, affiliations, software, etc. All of these [other] vendors have accuracy limitations.“

—Software & IT strategy senior VP

TYPES OF DATA

“What types of healthcare reference data matters most to you?” The list below represents types of reference data most ranked in the top 1st and 2nd positions.

- Executive contact information

- Provider names and contact information

- Clinical volumes and activity

- Purchasing relationships

- Quality metrics

- Financial metrics

- Sizing and operating metrics

- Practice locations

- Provider specialties

- Physician and HCP affiliations across all facility types

Leaders across diversified organizations said executive contact information matters most, followed by provider names and contact information, and clinical volumes and activity. Respondents ranked Definitive Healthcare as a leading vendor for all of these types of data.

Among diversified organizations, hospitals (58%), physician groups (42%), and GPOs (41%) are the most sought-after subjects of affiliations data. Contextual data—e.g., reference and affiliation data layered over healthcare facility information—is preferred over contact data alone by a two-to-one margin. Contextual data delivers insights into prescribing, treatment, and referral behaviors between providers as well as the influence and decision-making capacity of healthcare professionals within an organization. Definitive Healthcare’s Atlas Dataset provides both contact data and contextual data.

The factors that drive buying decisions

Every vendor has a different approach to healthcare reference and affiliation data. Specific offerings, analytical methods, sources used, and modes of access vary by vendor, so choosing the right one can make all the difference in maximizing the data’s strategic impact.

Diversified organizations said that the accuracy of the data, the completeness of the datasets, and the ease of accessing and interpreting data were the most important factors when evaluating vendors. Interestingly, healthcare providers and life science organizations prioritized the same factors in our previous survey.

The timeliness of when data is made available was another critical factor for responding organizations. Branding, however, was a non-issue—more than a third of respondents rated it as “not important.”

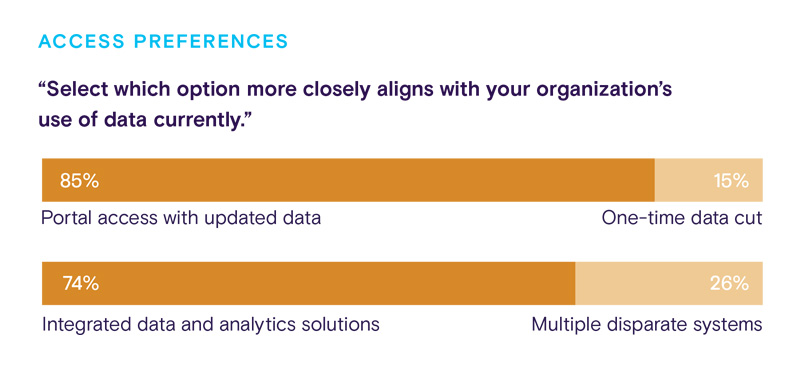

When it comes to vendors’ data product and service offerings, sales and marketing leaders lean toward bespoke solutions over prepackaged datasets: Users prefer to select their own data fields over receiving a multitude of data points by a nearly two-to-one margin. A considerably smaller margin prefers custom solutions over out-of-the-box products.

“The amount of information available is vast, rich and complete. It helps commercial organizations understand targets from both a facility and individual standpoint.”

—Software & IT sales VP

Diversified organizations’ access habits reflect their overall preferences for in-house control and customization.

Customer relationship management (CRM) tools represent the most favored data access method for a plurality of respondents (38%), and nearly two-thirds say their organizations are already using CRMs for this purpose.

Even so, most diversified organizations still want an option to access continuously updated data and analytics through a portal. The Atlas Dataset is accessible through a variety of formats, including users’ internal systems and our web-based platform, with data available in industry-focused solutions or client-tailored packages.

Many teams are missing out

Most organizations strongly agree that analytics on healthcare reference and affiliation data (61%) and real-world data (60%) play an important role in their organization, but only about half say they have the data and insights they need.

TOP CHALLENGES TO ACCESS

Percentage of respondents who “highly agree” with the following statements:

- 56% Our teams have the data and insights they need to identify the right prospects

- 39% Our teams spend a lot of time matching data across datasets

With nearly half of the respondents expressing limited confidence in their existing datasets, and 39% saying they burn time and resources on data matching, there’s clear room for improvement both in terms of access and utilization. Many teams are missing the healthcare reference and affiliation data they need, and a good portion of those who have that data aren’t leveraging it to its fullest potential.

“Definitive Healthcare has the easiest database to navigate and find key contacts for targeting.”

—Software & IT marketing c-suite

Ingesting, cleansing, contextualizing, and analyzing data is labor-intensive—and likely not the focus or core competency of busy sales and marketing teams. Most organizations can benefit from a data partner that handles these processes, so users can concentrate on getting answers to their critical questions.

“Definitive Healthcare’s platform offers a comprehensive view of the healthcare ecosystem, including detailed information on providers, hospitals, and other healthcare organizations, as well as their affiliations, referrals, and key contacts. They also provide analytics and insights to help healthcare organizations make informed decisions and improve patient outcomes.”

—Medical supplies marketing manager

What it all means

The survey results highlight the critical role that healthcare reference and affiliation data plays in organizations across multiple industries, including software, information technology, facility services, and medical supply. The results demonstrate how maximizing this data’s strategic impact comes down to choosing the right vendor with the right offerings for an organization’s unique needs. According to survey respondents, Definitive Healthcare is the leading vendor for reference and affiliation data, ranking first among all vendors for the top 10 use cases and in eight data categories, including best reference and affiliation data.

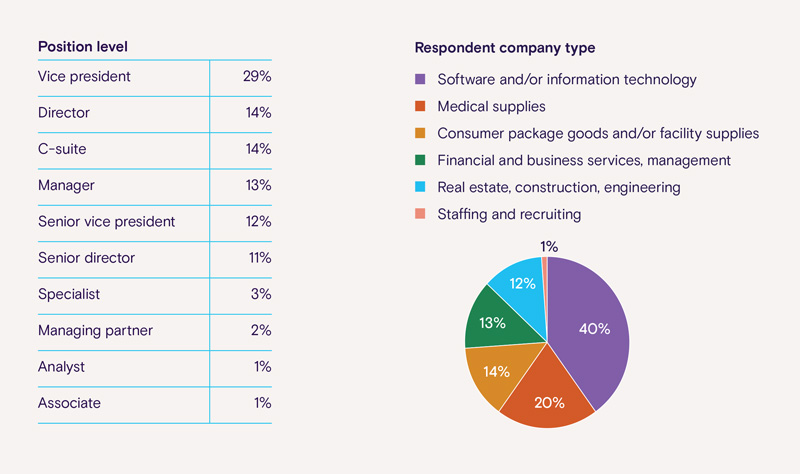

Study methodology

A leading independent market research firm conducted the survey in April 2023. The survey polled 100 leaders among software, information technology, facility services, and medical supply organizations.

About the respondents

The survey included 100 professionals from software, information technology, facility and financial services, real estate, construction and engineering, and medical supply companies.