In case you missed it, Oracle agreed to acquire Cerner, a large electronic health records (EHR) vendor, to the tune of $28.3 billion.

For Oracle, a database and cloud computing giant, this move could potentially give them even more control over the increasingly competitive market to sell technology and related services to the healthcare industry. For healthcare providers, the outcome of this deal could streamline the delivery of critical care information, potentially resulting in better patient outcomes.

Either way, this transaction could shape up to have huge implications for healthcare technology. To better understand exactly what Oracle stands to gain from this acquisition, we dug deep into Cerner’s presence in the healthcare industry.

Cerner holds a huge share of the EHR market

Cerner has a significant presence in hospitals and health systems across the U.S. They provide an interoperable, patient-centered EHR platform designed to help healthcare professionals prioritize the delivery of care by relieving the time-consuming burden of accessing and recording patient information.

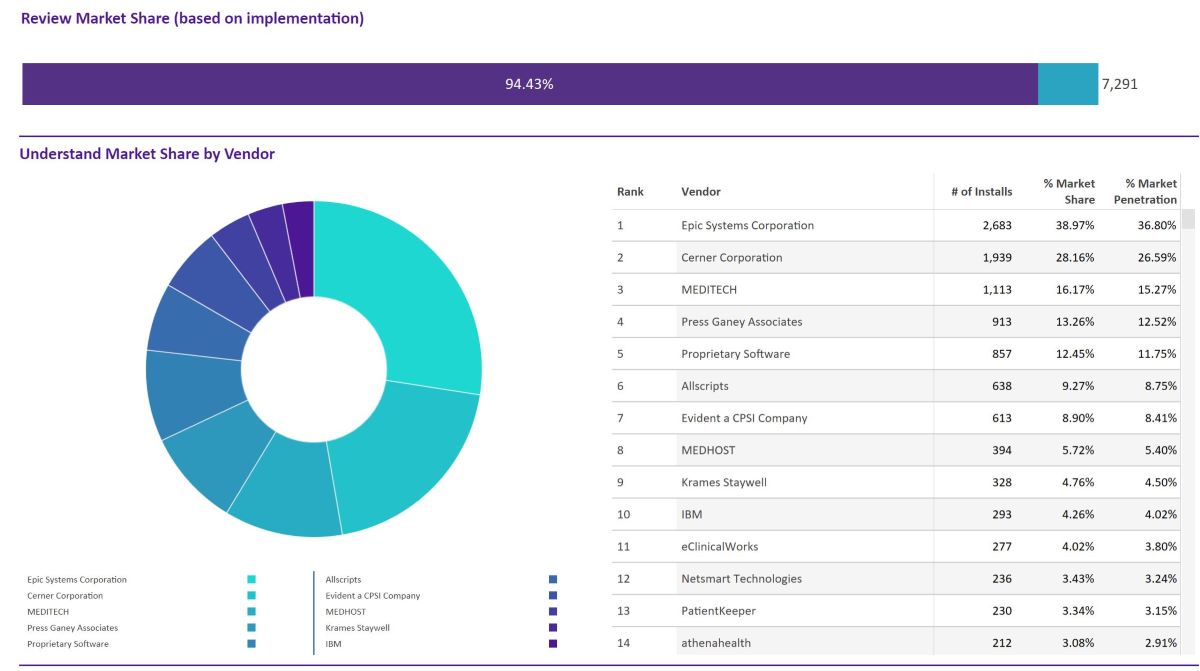

From the donut chart above, we can see that Cerner is the second largest provider of EHRs in the U.S. Of the 9,100+ hospitals analyzed in our HospitalView product, Cerner Corporation’s EHR platform is currently installed in 1,939 locations or approximately 28% of the EHR market. Oracle is in second place behind Epic Systems Corporation, which has 2,683 installs and an approximate 39% market share.

By acquiring Cerner, Oracle can leverage its considerable cloud computing infrastructure to optimize how Cerner’s electronic health records are created, stored, secured, accessed and shared. According to Larry Ellison, Oracle’s Chairman and CTO, a smoother approach to navigating medical information systems could potentially lead to reduced overall health costs, enhanced patient privacy and a streamlined administrative workload for physicians and nurses.

Oracle may try to position itself as a one-stop-shop for healthcare IT

Beyond an EHR platform, Cerner also has powerful tools and applications to help hospitals and health systems manage the huge quantities of data flowing through them. Cerner provides platforms for tracking emergency departments, telemedicine and virtual health options, hospital bed management and more.

As we can see from the table below, Oracle also has an established, competitive presence in hospitals and health systems, providing database management and software products across several logistical, financial and clinical functions.

Category | Technology | Count of installations | Estimated market share % |

Human Resources | Workforce Management Solutions | 2,314 | 56% |

General Financials | Financial Management | 1,690 | 21% |

Supply Chain Management | Supplier Relationship Management (SRM) | 1,640 | 22% |

Human Resources | Personnel Management | 1,618 | 20% |

Human Resources | Payroll | 1,528 | 18% |

Human Resources | Benefits Administration | 1,519 | 20% |

Supply Chain Management | Inventory Management | 1,519 | 21% |

Supply Chain Management | Enterprise Resource Planning | 1,457 | 30% |

General Financials | General Ledger | 1,447 | 18% |

Supply Chain Management | Procurement | 1,443 | 24% |

General Financials | Accounts Payable | 1,368 | 18% |

Supply Chain Management | Asset Tracking/Management | 1,102 | 36% |

Supply Chain Management | Materials Management | 1,087 | 13% |

Information Sharing | Interface Engines | 812 | 13% |

General Financials | Budgeting | 780 | 11% |

IS Infrastructure - Software | Data Warehousing/Mining | 629 | 13% |

General Financials | Cost Accounting | 535 | 9% |

By bringing Cerner into the fold, Oracle can firmly entrench itself in the healthcare industry and will likely try to position itself as a highly competitive player in the space with a broad suite of healthcare IT solutions.

Are we seeing an evolution in healthcare technology?

For years, big tech companies like Microsoft, Google and Amazon Web Services have been building products and infrastructure for the healthcare industry.

With Oracle’s recent acquisition of Cerner, and Microsoft’s April 2021 acquisition of Nuance Communications Inc., a speech-recognition and artificial intelligence company, we may be seeing an evolution of healthcare technology aimed at alleviating the administrative burden healthcare professionals deal with today. In a 2020 Mayo Clinic study, doctors are spending an hour or two on administrative tasks or EHRs for every hour they spend caring for patients.

According to Oracle, their acquisition of Cerner now gives them the capacity to address these issues and arm healthcare professionals with better information. In the years to come, we may see a bigger push for connected technologies in hospital settings by means of voice-operated user interfaces, cloud computing and solutions powered by artificial intelligence.

You can hear more discussion about this acquisition, and learn more about the moves big tech companies are making in the healthcare industry, by listening to episode three of our podcast.

Learn more

As more big tech companies reshape the healthcare industry, the more challenging it may become to navigate and compete within it. With healthcare commercial intelligence, you can arm yourself with the insights you need to stay on top of the latest changes and trends across the healthcare ecosystem.

You can start a free trial to see how our solutions can help you make more strategic decisions and grow your business.