Addressing the healthcare staffing shortage

The U.S. healthcare industry continues to face staffing shortages and the reasons why are complex and varied. As thousands of healthcare workers retire, transition to new roles, switch industries, or simply quit their jobs, the healthcare landscape is shifting into an uncertain future. In this report, we explore how healthcare organizations and providers are navigating the ongoing staffing shortage, and examine:

- Which hospitals and types of healthcare workers are most impacted

- The challenges organizations are facing now and will face in the future

- The driving forces behind the staffing shortage and a look at the solutions to address it

Now updated for 2023, this report includes new data and analysis as the healthcare staffing shortage continues to evolve. Download your copy for our data-driven perspective on the healthcare staffing shortage and how organizations and providers are working to overcome it.

Take the next step

Definitive Healthcare is the most comprehensive healthcare commercial intelligence platform, delivering information on every care provider in the U.S.

What’s inside

The report is divided into three parts:

- Part I: The current state of the staffing shortage

- Part II: The biggest challenges that healthcare organizations are navigating

- Part III: How did we get here? And what will the future look like?

From these findings, healthcare organizations can get a better understanding of the elements contributing to the ongoing provider staffing shortage and the challenges and obstacles the future may hold. In addition, healthcare providers and staffing and recruiting agencies can leverage this report to help guide their strategic planning and make more informed decisions as the landscape continues to evolve.

Part I: The current state of the staffing shortage

Nearly four years after the CDC confirmed the first case of COVID-19 in the U.S., the pandemic continues to affect communities across the country.

Healthcare workers on the frontlines face an unprecedented degree of pressure from multiple sources. New coronavirus variants, an evolving set of rules and regulations at the federal and state levels, delays in care, and even pushback from patients with strongly felt personal or political beliefs are straining healthcare workers to their breaking point.

Financial performance at hospitals and health systems continues to fluctuate due to declining patient volumes, labor expenses, and inflation in 2023. However, many organizations showed signs of improvement when compared to the previous year, according to a Kaufman Hall report.

It’s clear that COVID-19, and the problems that have arisen from the pandemic, have had a significant toll on the health and wellbeing of providers and hospitals alike. As a result, thousands of physicians and other healthcare workers are leaving their positions. Let’s look at the current state of the staffing shortage and see which specialties and facilities are impacted the most.

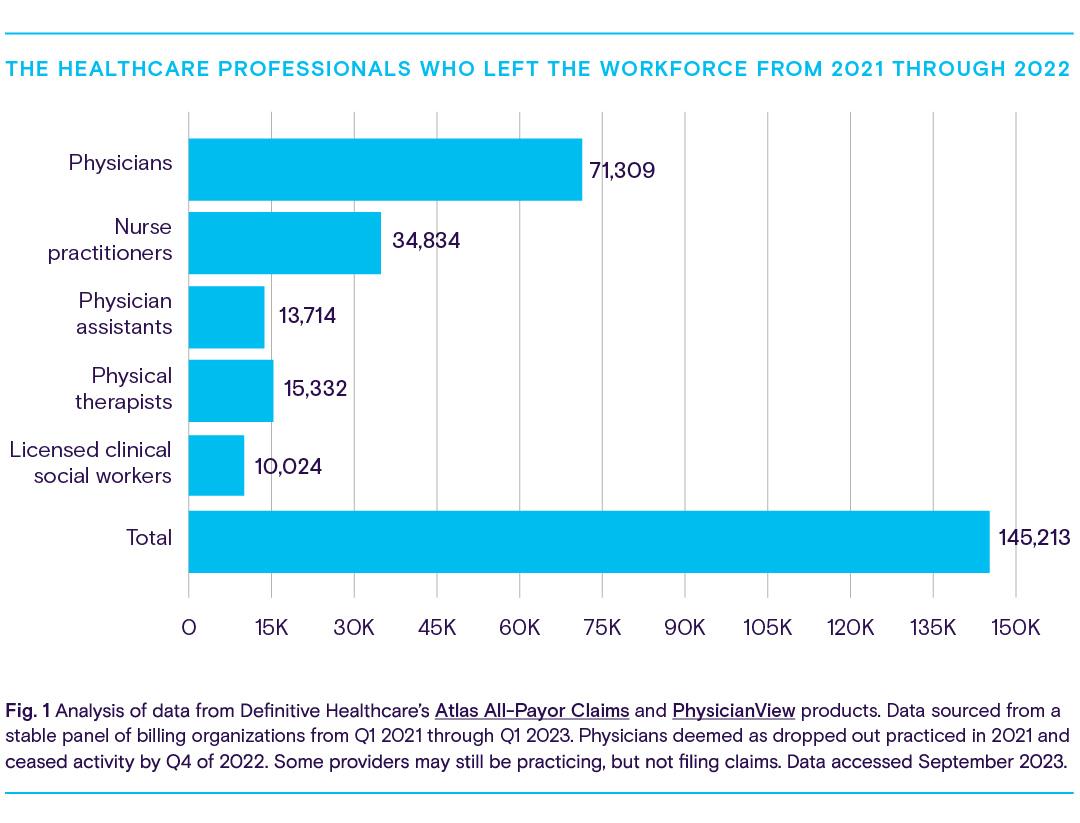

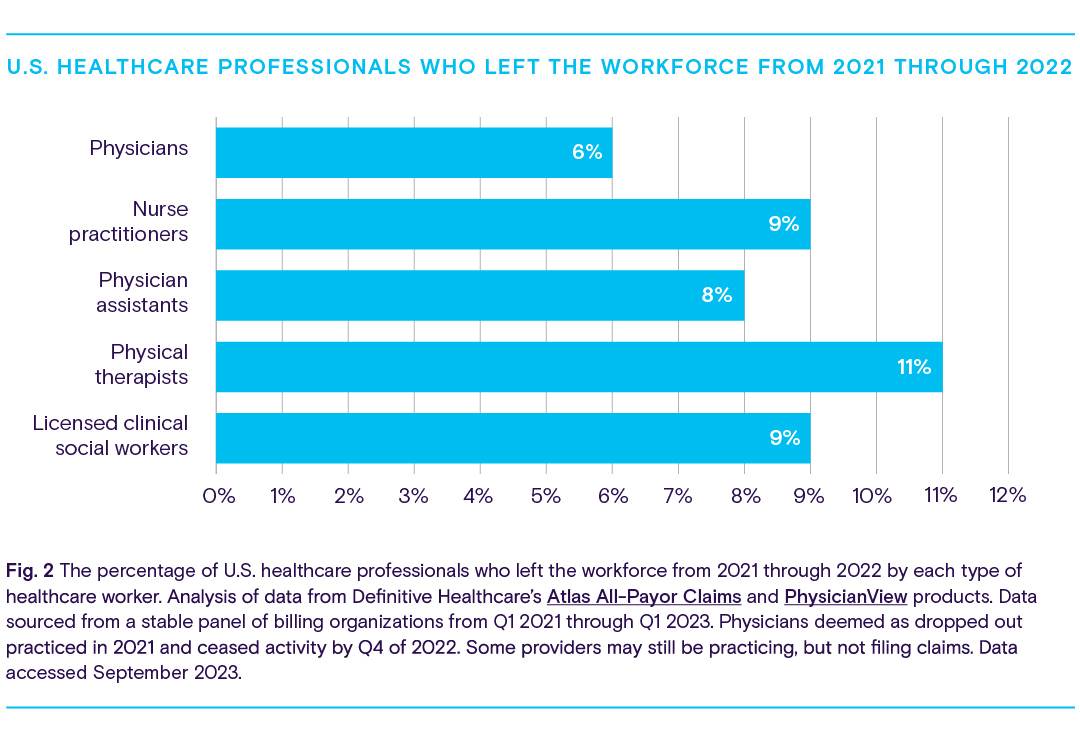

The types of providers leaving the workforce

The chart below shows the quantity and types of healthcare providers who left the workforce from 2021 through 2022.

By the end of 2022, a total of 145,213 healthcare providers left the profession. There are multiple different reasons behind their departure. Many of these healthcare providers work in direct contact with older adults and people living with disabilities, two patient populations who are more vulnerable to COVID-19. As a result, these providers are more exposed to the negative effects of treating COVID-19 patients: a fear of infection, untenable hours, depression and stress, and the emotional toll of the loss of patients, as well as the loss of their colleagues fighting the pandemic.

One particularly concerning outcome of the staffing shortage is the departure of 34,834 nurse practitioners across the country. While it’s likely that many nurse practitioners left the workforce for the reasons discussed earlier, data suggests these workers have also been transitioning into new roles.

It’s no secret that the pandemic transformed the way patients engage with their doctors and receive care. Unable to visit their doctors face-to-face, patients instead turned to outpatient clinics, ambulatory surgery centers, and home healthcare agencies, and used telemedicine to get the care they needed.

As the landscape changed, new opportunities arose for healthcare workers, particularly nurses. The growing demand for specialized care, alongside the growing population of patients and older adults pursuing care at home, encouraged many nurse practitioners to become travel nurses.

Travel nurses are registered nurses who take temporary nursing positions in hospitals, clinics, and other high-need facilities. In 2021, the demand for travel nurses grew by 40%.

Demand for travel nurses plummeted by 42% in the first half of 2022

Many nurses transitioned into a travel nurse role to take advantage of dramatically increased pay, flexible working hours, and better locations.

Recent trends, however, suggest that the tide may be turning for travel nurses. Data from staffing firm Aya Healthcare reveals that national demand for registered travel nurses plummeted by 42% from January to July 2022. During this time, NBC reported that COVID-19 hospitalization rates had stabilized and relief funding was depleted, both likely contributing to this decline. The article goes on to explain how less demand has led to a considerable, and abrupt, decline in pay, which has left many travel nurses shocked and feeling pressured to accept lower-paying contracts they might have otherwise declined.

While it may be too early to speculate if demand for travel nurses will rise once again, it’s clear that the role of a nurse—and how much organizations are willing to pay for their expertise—is in flux. Registered nurses and staffing and recruiting agencies will need to keep a close eye on market opportunities as the healthcare industry continues to evolve.

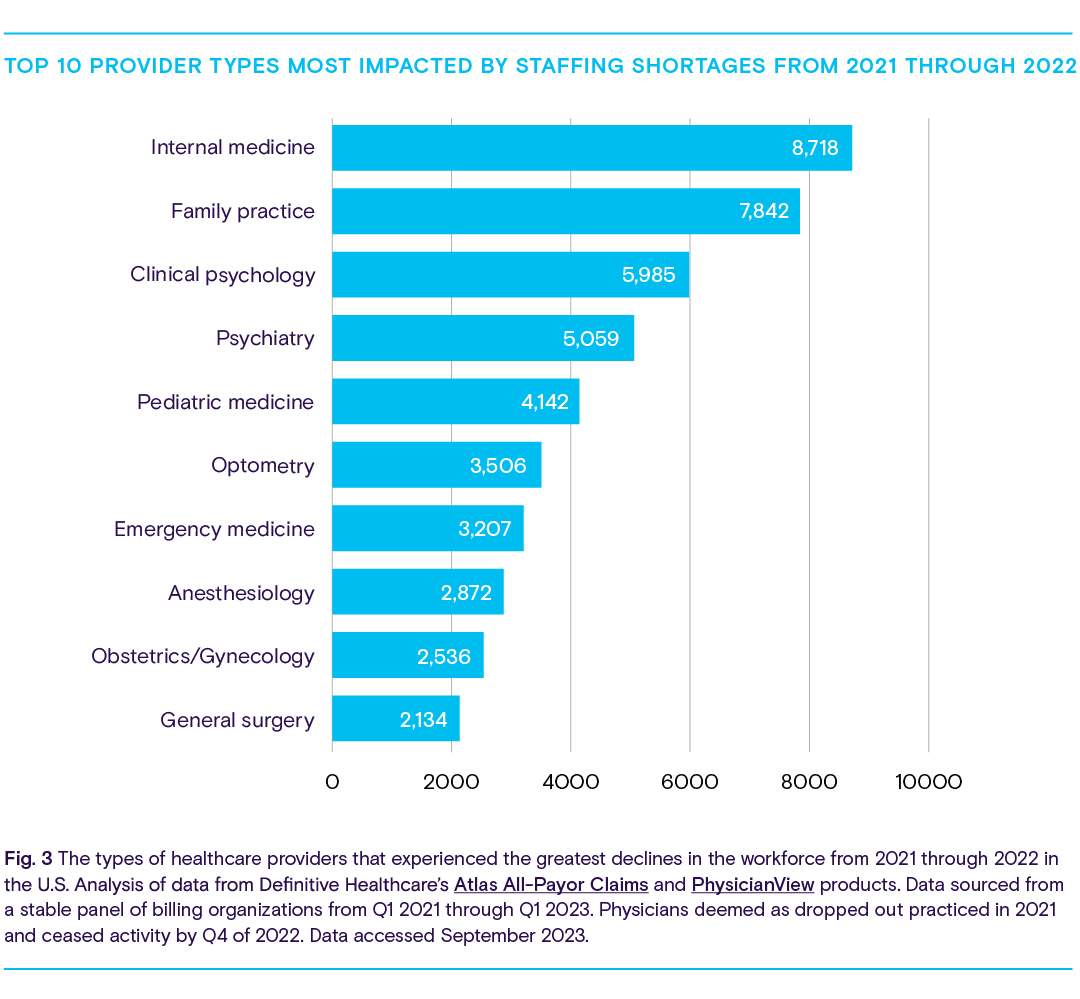

Provider types that have lost the most workers

Providers across the healthcare landscape have been leaving the workforce. The chart below shows which type of provider lost the most workers from 2021 through 2022.

The fields of internal medicine, family practice, and clinical psychology were among the types of providers most impacted by staffing shortages from 2021 through 2022. Workers in these specialties were frequently on the frontlines during the pandemic, risking exposure to the coronavirus and facing many of the pressures and stressors described earlier.

The considerably high number of professionals leaving optometry, obstetrics/ gynecology, and anesthesiology may also indicate the significance of some of the ways COVID-19 impacted healthcare. Examinations in these fields typically require the patient to meet face-to-face with their doctor, which wasn’t always possible during the height of the pandemic. This contributed to billions of dollars in lost revenue for healthcare practices of all fields, but anesthesiology and optometry may have faced more difficulty recouping costs or adapting due to the complex technologies involved or physical contact needed to examine the patient. To compensate, many practices resorted to furloughing employees or shuttering their doors—sometimes for good.

Hospitals across the U.S. are facing critical staffing shortages

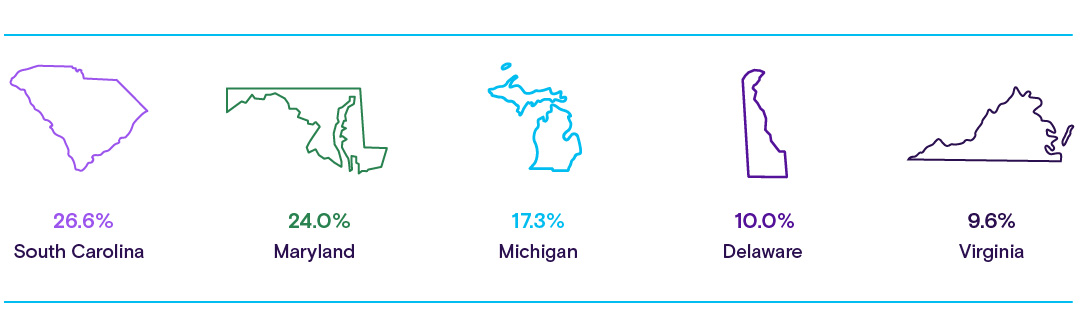

Hospitals across the country are grappling with widespread staffing shortages. Using data from the Department of Health and Human Services and Becker’s Hospital Review, it’s possible to see which states have the highest percentage of hospitals experiencing critical staffing shortages. A “critical” designation is declared when a facility has activated its contingency staffing strategy and has exhausted all options to address staffing needs.

Becker’s Hospital Review reported in September 2023 that the states with hospitals that experienced the most critical staffing shortages are South Carolina, Maryland, Michigan, Delaware, and Virginia. It’s important to note that not all states report how many hospitals experience a staffing shortage.

There may be multiple reasons why hospitals in these states reported high numbers of critical staffing shortages. According to the New York Times, coronavirus cases and hospitalizations fell steadily through 2022. However, Michigan, Virginia, and South Carolina all ranked highly on the total number of COVID-19 cases during the year. One year later, COVID-19 cases in these three states remain high, ranking 10, 14, and 19 respectively, according to Statista’s March 2023 report.

Interestingly, Delaware, which is ranked 44, reported far fewer COVID-19 cases than the other four states that experienced critical staffing shortages. This ranking may indicate that handling coronavirus cases isn’t the only factor contributing to shortages.

Part II: The biggest challenges that healthcare organizations are navigating

When any organization is short on staff, the consequences are immediately and tangibly felt. Operations are scaled back, hours are reduced, and some companies close their doors altogether. Shortages in the healthcare industry not only affect providers and an organization’s bottom line, but they also negatively impact communities by creating unforeseen challenges and reinforcing barriers to care.

In this part of the report, we’ll explore some of the current and future problems created by—or made worse by—the provider staffing shortage. These challenges are:

- Hospitals continue to struggle with high expenses

- Healthcare organizations are feeling pressured to consolidate

- The safety of patients is at risk

- The knowledge pool is being drained

- Rural communities are suffering (and may continue to suffer)

Hospitals continue to struggle with high expenses

During the early days of the pandemic in 2020, the healthcare market faced significant declines in patient volumes. This was caused by safety concerns about contracting the coronavirus, the mandated cancellations of elective surgeries, supply chain issues, and facility capacity problems due to the need to prioritize COVID-19 cases.

This decline in patient volumes led to massive financial losses for health systems. Further compounded by staffing shortages, hospitals relied on contracted labor and temporary healthcare staffing agencies to supplement their care teams and keep costs low because contract labor can be scaled to demand.

The market has continued to shift throughout 2022 and 2023, and hospital financial performance appears to be troubling. While contract labor expenses appear to be declining, some reports argue that this outcome is a result of workforce reductions and staff turnover.

Challenges remain in other financial areas as well. As reported by Kaufman Hall in a 2023 report, hospitals continue to struggle against economic pressures such as rising inflation and high supplies and purchased services expenses. Hospitals are accruing more bad debt and performing more charity care, possibly as a result of many states across the U.S. redetermining who is eligible for Medicaid. In addition, average lengths of stay and emergency department visits are down. Coupled with increases in outpatient revenue, these market shifts may indicate that people are continuing to favor outpatient settings over inpatient.

Ultimately, these economic forces are creating a challenging environment for hospitals, and leaders at these facilities will likely need to develop or revise their strategies for long-term sustainability.

Healthcare organizations are feeling pressured to consolidate

Today, hospitals are operating on razor-thin margins, strained by rising inflation, staffing shortages, and COVID-19. In a report by the American Hospital Association, supply costs per patient rose by 18.5%, medical supply costs per patient increased by 32%, and median drug costs per patient went up by 31.6% between 2021 and 2022.

As a result, facilities are experiencing increased pressure to scale via consolidation. Definitive Healthcare data reveal that healthcare organizations are searching for ways to lower overhead and operate at scale by adding more providers, beds, physician practices, and imaging centers to their network.

- The top 10 healthcare systems in 2019 are the same 10 systems in 2022. They own 17% of hospital beds.

- The largest healthcare systems added 10,000 beds, 35 hospitals, and 163 physician groups in the past three years.

- HCA Healthcare has remained the largest healthcare system in the U.S. since 2019. Its bed count has grown by 10%.

The safety of patients is at risk

With fewer healthcare professionals on staff, the likelihood of a medical error increases. A study from Johns Hopkins Medicine suggests that medical errors account for more than 250,000 deaths annually.

According to Johns Hopkins Medicine, medical errors account for > 250k deaths annually in the U.S.

According to the doctors themselves, the staffing shortage is one of the major contributors to medical errors. In early 2022, Survey Health Global (SHG) and Apollo Intelligence released a report on the mental health of healthcare professionals in six nations across the globe. From the report, 34% of doctors worldwide observed increased medical errors and attributed the cause in part to staffing shortages and constant stress. Studies have found correlation between poor mental health and burnout leading to medical errors and diminishing patient safety.

Beyond medical errors, the ongoing staffing shortage is also worsening the patient experience and the quality of care. Respondents to the SHG survey also reported that shortages have led to longer wait times for patients to receive care or outright delays in access to diagnosis and treatment. Thirty percent of respondents said staffing shortages and the resulting delays have increased patient suffering and negatively impacted patient health.

Overworked and understaffed medical teams may also make more avoidable mistakes when cognitive failure is high. Cognitive failure can be a result of stress, a lack of expertise to adequately deliver care, a heavy patient load, or poor mental health, among other factors. When cognitive failure is high, healthcare workers may be more likely to find shortcuts in safety procedures, insufficiently monitor patients after a procedure, or suffer injuries from physical hazards.

The knowledge pool is being drained

While a doctor or nurse who has left the workforce can be replaced, knowledge cannot. In an article published in The Atlantic, Ed Yong describes how the collective knowledge loss can be damaging to both providers and patients alike when experienced healthcare professionals quit.

During the height of the pandemic, many veteran healthcare workers opted for early retirement. Some older physicians cited personal health concerns or worries about contracting the virus. Others stated that stress and burnout from heavy patient loads and long hours pushed them into thinking about or pursuing retirement, according to a 2021 poll by the Medical Group Management Association (MGMA).

Regardless of their reasons, when a healthcare professional leaves the workforce, everyone loses. In their article, Yong writes that the wave of retiring healthcare workers has lowered the average experience level of hospital employees.

“When inexperienced recruits are trained by inexperienced staff, the knowledge deficit deepens.”

And this can extend beyond medical expertise. The loss of veteran healthcare providers is also a blow to younger and inexperienced workers looking to develop much-needed social skills learned on the job.

Yong says that the ability to question inappropriate decisions or for an inexperienced provider to recognize when they are out of their depth can be crucial to preventing medical mistakes. Their more experienced colleagues can help build these safeguards by serving as a resource for advice, guidance, and education.

Lower-quality work can have devastating outcomes for patients, leading to increased medical errors, reduced mortality, increased readmissions, and more.

Rural communities are suffering (and may continue to suffer)

For hospitals serving communities in rural areas, staffing shortages are nothing new. A policy brief published in 2012 by the National Rural Health Association noted the significance of healthcare labor shortages across rural America and predicted that conditions weren’t likely to improve in the future.

A decade later, access to quality healthcare in rural communities remains one of the industry’s most challenging problems.

Statistically, rural areas tend to have fewer physicians, nurses, specialists, and other healthcare workers. People living there are also more likely to be older, less affluent, less well-insured, and sicker than people in urban communities.

These conditions have magnified the negative impacts of the ongoing staffing shortage, leading hospital executives to make difficult choices to stay afloat. Multiple surveys by The Chartis Group paint a grim picture. In one survey, 27% of respondents said that nurse staffing-related issues have led to the suspension of services, and 22% of respondents said that is something being considered. Nearly all respondents indicated that filling vacant nursing positions was the most challenging issue.

Many nurses are leaving positions at rural hospitals for the reasons outlined in Part I: higher pay, flexible hours, and better locations to work and live. In fact, 42% of respondents from another Chartis Group survey said better-paying jobs were the number one reason behind nursing departures in 2022.

As larger hospitals in urban areas lure nurses and other healthcare workers with hefty bonuses, rural hospitals are struggling to compete. In contrast, rural hospitals offer smaller salaries, further enhancing the attractiveness of pursuing opportunities elsewhere. Staffing shortages have pushed many small hospitals in rural areas to refuse the admittance of patients, close inpatient wards, and limit or suspend outpatient services.

These conditions have left rural hospitals vulnerable to closure. Meanwhile, the providers who remain open face increasing costs from recruitment and contract labor. High turnover can also make it more challenging to maintain a high standard of care and safety. And perhaps most importantly, staffing shortages are causing the erosion of trust communities have placed in the facilities that serve them. Unique solutions will need to be found to combat these problems.

Part III: How did we get here? And what will the future look like?

In this part of the report, we’ll explore some of the driving forces behind the healthcare staffing shortage. They are:

- Population growth and aging is leading to increased demand for care

- Many physicians are nearing retirement age

- Feelings of burnout

Population growth and aging is leading to increased demand for care

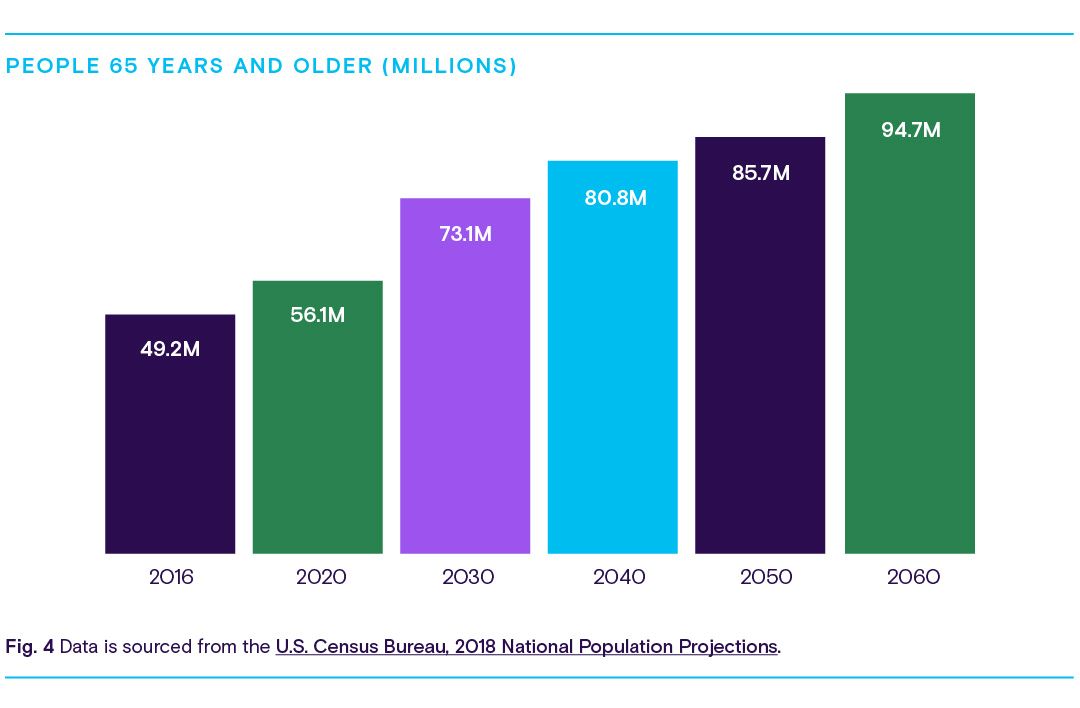

Population growth is one of the primary drivers of demand for care. Demographics data from Association of American Medical Colleges (AAMC) reports that the U.S. population will grow from 332 million in 2022 to 361 million in 2032. We can track how many older adults there may be by 2032 by using U.S. Census Bureau data.

As the population continues to age, more patients over the age of 65 will need specialized healthcare to manage chronic conditions over a longer period than previous generations. As a result, demand for geriatricians and other specialists will likely rise, shifting the balance of available providers able to serve the general population. There will be roughly 73 million adults over the age of 65 by 2032, which will account for 42% of physician demand.

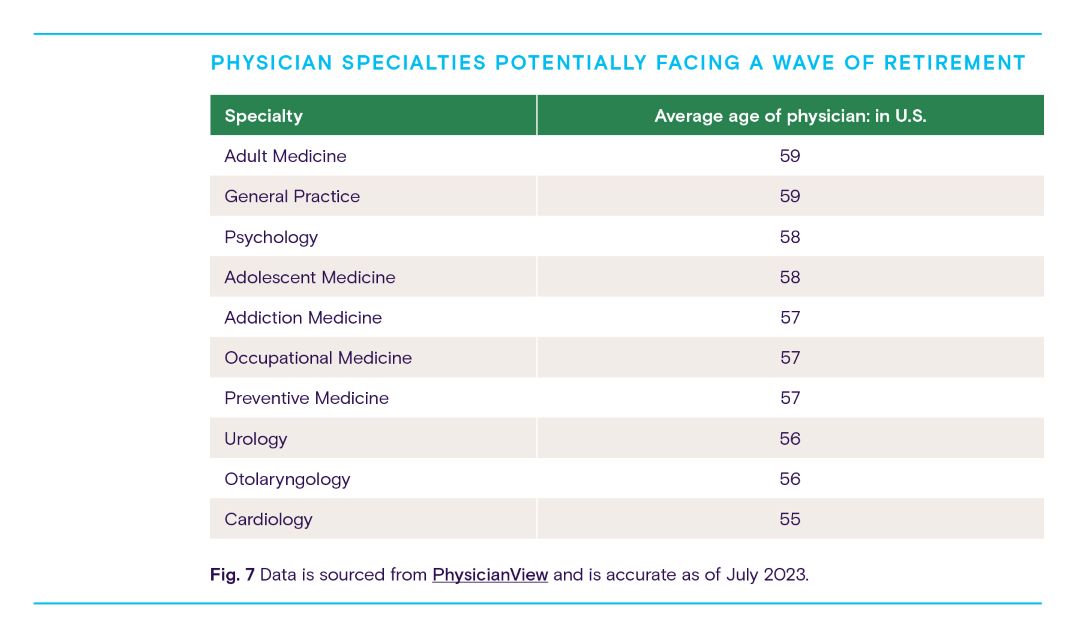

Many physicians are nearing retirement age

As the general population ages, so does the healthcare workforce.

According to Definitive Healthcare data, many physicians across several healthcare specialties are on the verge of retirement or will be near that age soon. In fact, research from the AAMC found that nearly 45% of doctors are older than age 55, and more than 40% of active physicians will be 65 or older in the next ten years. A wave of retirement can be especially detrimental to the workers left behind. As described in Part II, younger and inexperienced physicians will lose a valuable learning resource, which in turn may increase the likelihood of poor health outcomes for patients.

We can use our data to determine which specialties are at risk within the next decade.

While it may take years for many providers to retire from the workforce, healthcare providers should be actively taking steps to address this right now. The most obvious reason to develop an action plan now is that it can take upwards of a decade to educate and train a new physician. Time, however, isn’t the only concern. Feelings of burnout heightened by the COVID-19 pandemic have already pushed thousands of healthcare workers into early retirement.

Feelings of burnout

While the aging population of patients and physicians paints an uncertain future of what healthcare might look like over the next decade, physician burnout is a much more immediate concern.

Physician burnout is a feeling of long-term emotional exhaustion. The AHRQ says this can damage morale, cause healthcare professionals to quit practicing medicine and even lead to depression, alcohol abuse, and thoughts of suicide.

Burnout is a serious problem. Not only does it contribute to staffing shortages, but it can also reduce the quality of patient care or even place patients in harmful situations. One study reports that burnout can increase the likelihood of medical errors and malpractice, lower patient satisfaction, and hinder physicians from forming interpersonal relationships with their patients. Another study found that between 35% and 54% of nurses and physicians already felt burned out before the pandemic. And now, many have been “pushed to their breaking point” and simply resigned.

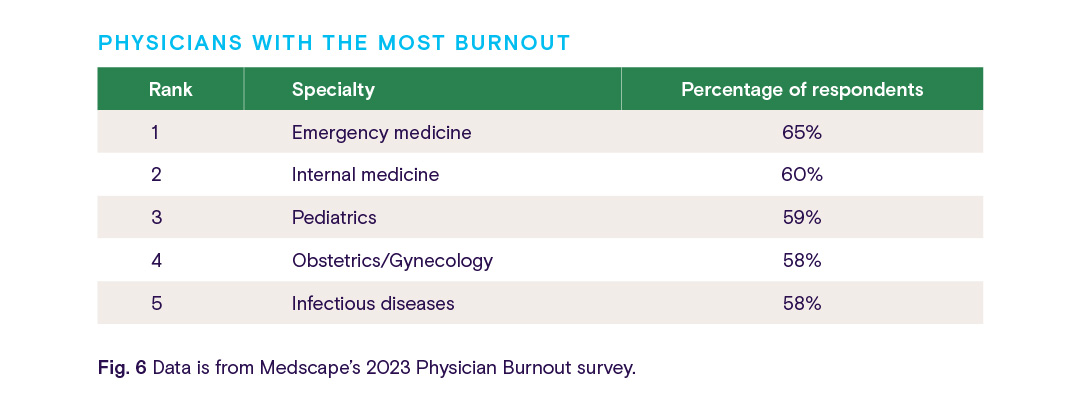

Which physicians are the most burnt out?

In late 2022, Medscape polled more than 9,000 physicians and asked them to share their experiences and attitudes toward physician burnout and depression. According to the report, the top five physician specialties feeling the most stressed are:

As the COVID-19 pandemic continues, it’s no surprise that physicians in emergency medicine, critical care, infectious diseases, and family medicine are reporting how overwhelmed they feel. An article from The Guardian describes a wave of “compassion fatigue” targeting workers in these specialties. The post goes on to say that treating unvaccinated patients can be especially emotionally exhausting due to strongly felt political or personal beliefs.

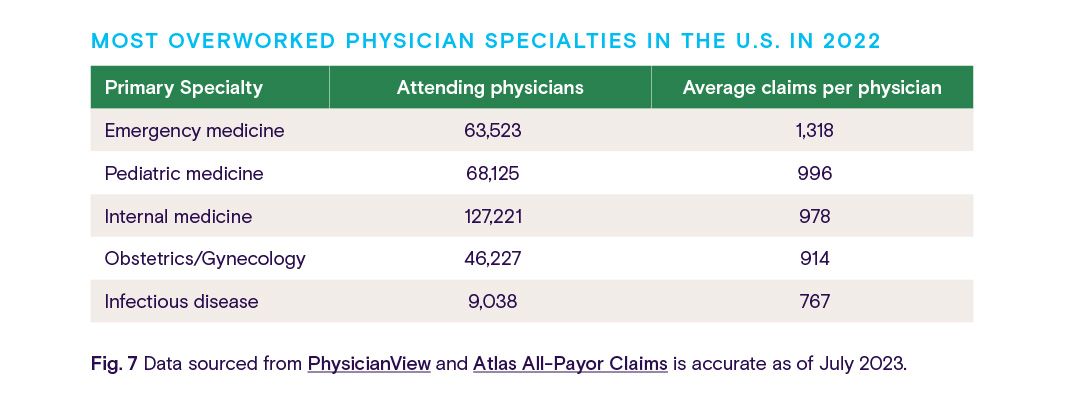

By using PhysicianView and Atlas All-Payor Claims, we can gain a better understanding of the workload of these specialties based on the average number of procedure claims per physician throughout 2022.

While being overworked contributes to physician burnout, it’s not the only factor. In fact, it’s not even the primary concern held among doctors and medical students. Three of the biggest reasons why healthcare professionals are burning out are:

- Too many administrative tasks

- Poor work-life balance

- Insufficient salary

Too many administrative tasks

Electronic health records (EHRs) are vitally important tools in healthcare. These systems are designed to improve communication and patient outcomes by cutting down on unnecessary paperwork and streamlining administrative tasks.

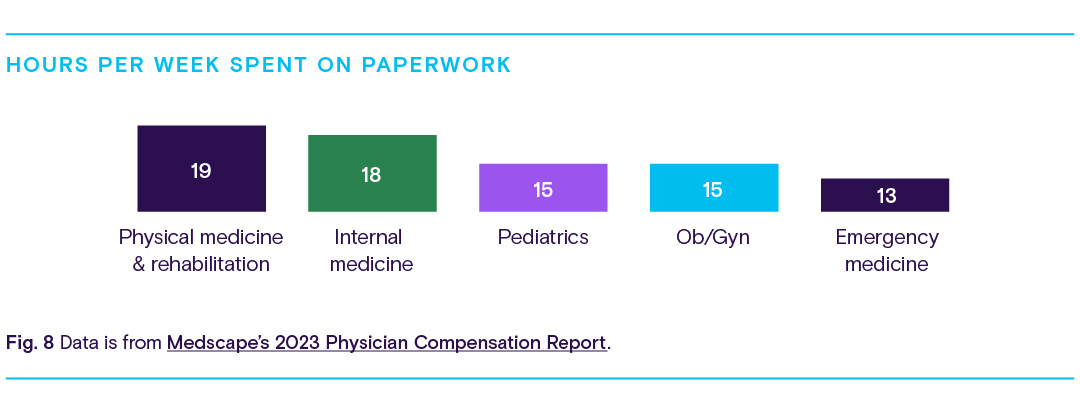

Many providers, however, say that more work needs to be done to reduce the hours spent charting, documenting, and dealing with reports. Too many bureaucratic tasks topped Medscape’s Physician Burnout & Depression Report. About 60% of respondents said it was the primary cause of their burnout.

From the report, we can see that the specialties discussed above are also among the top specialties spending the most amount of time on paperwork.

Poor work-life balance

Being a healthcare professional is stressful. The hours are long, and free time is scarce. Balancing time spent with patients and time spent with paperwork can be a struggle.

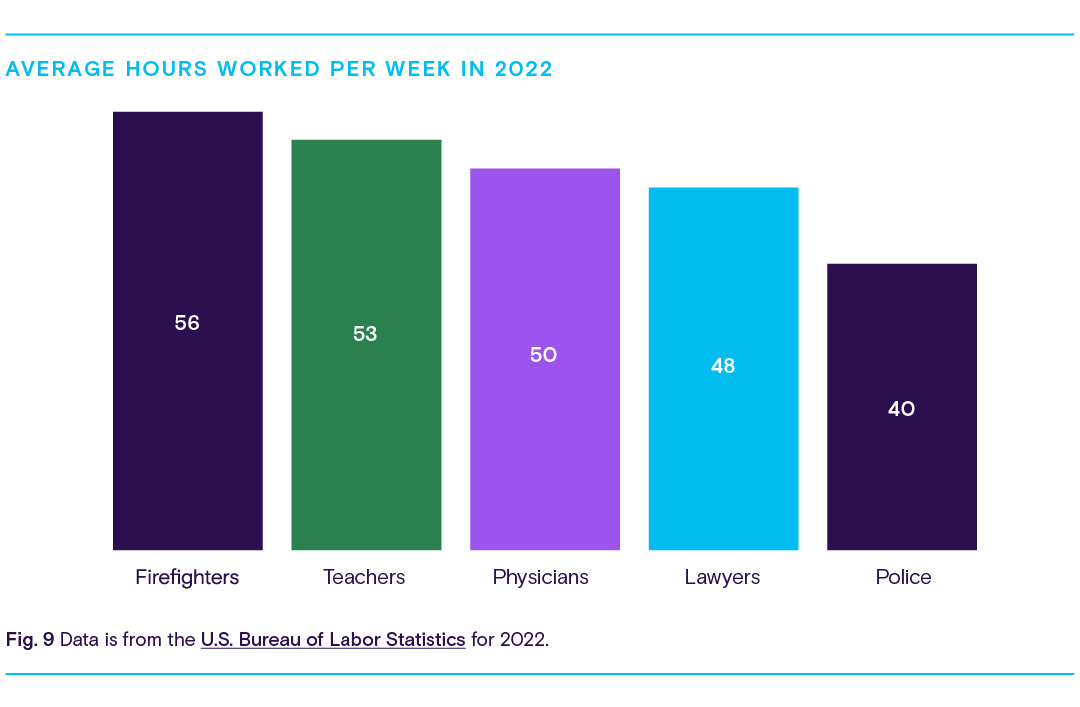

For many doctors and nurses, working long hours is the norm. In fact, the average physician works about 16 hours longer per week than the average employee in the U.S. We can use average weekly work rates from the U.S. Bureau of Labor Statistics to compare how many hours physicians work each week compared to other positions prone to burnout.

From the chart, we can see physicians are ranked second, working an average of 50 hours per week.

Working long hours each week can be physically, mentally, and emotionally draining. About 48% of physicians reported feeling burned out after working 50 – 60 hours a week. And this percentage rises even higher as the number of hours worked increases. As described earlier, this could result in more frequent medical errors, poor patient relationships and satisfaction, and a general lack of quality sleep.

Insufficient salary

About 48% of respondents to Medscape’s poll felt they weren’t being paid enough and indicated that their insufficient salary was another cause behind their burnout. In a similar poll, about 45% said increased compensation would help avoid feelings of fatigue and financial stress.

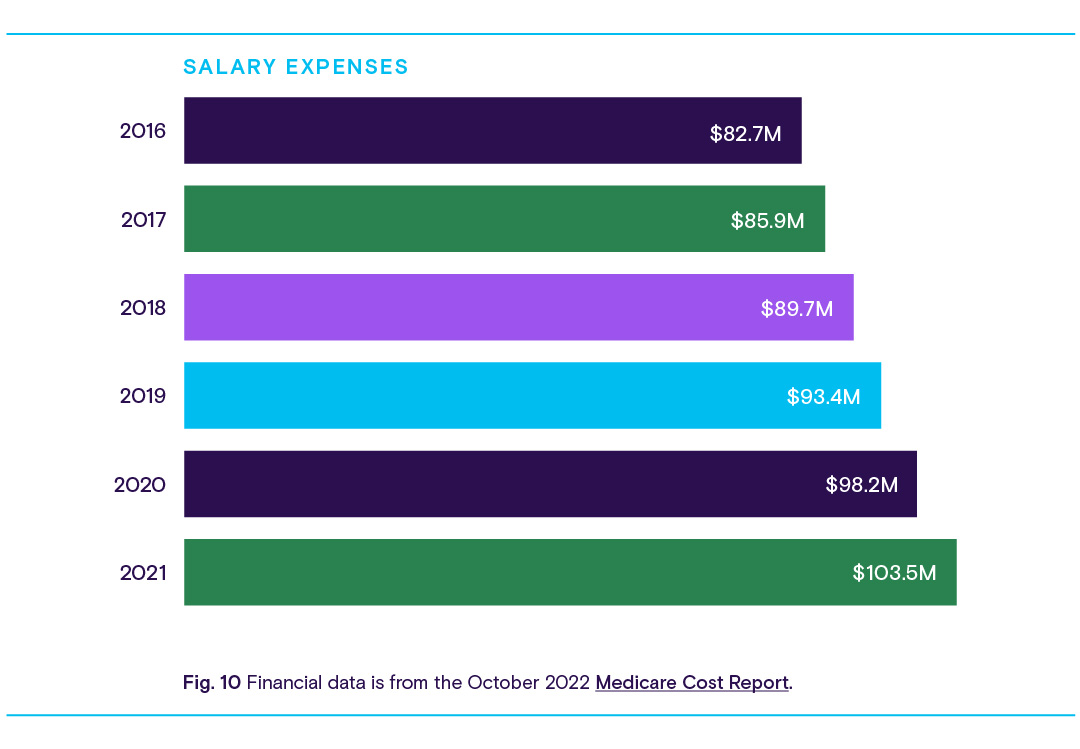

Despite this, hospitals and health systems are spending more money to hire and retain healthcare workers. These facilities are increasing salaries, offering sign-on bonuses, and expanding benefits to lure in new workers.

By using Definitive Healthcare data, we can see that hospitals are spending more money on hospital employees and physician salaries than they have in recent years.

While physician salaries are increasing year-over-year, it’s likely that not all specialties are growing equally. According to Medscape’s 2023 Physician Compensation Report, specialties like oncology, gastroenterology, and anesthesiology saw the biggest increases in compensation. Meanwhile, ophthalmology, emergency medicine, and rheumatology saw declines, likely due to Medicare cuts and stagnant reimbursements.

How can we treat the healthcare staffing shortage?

Healthcare organizations across the industry, and the communities they serve, are already feeling the effects of staffing shortages today. Unfortunately, trends in the data suggest that labor shortages will continue into the next decade as workers retire, transition into new roles to meet demand, and reevaluate the physical, mental, and emotional toll that comes with being a healthcare provider.

Fortunately, hospitals and other healthcare organizations are aware of these challenges, and it is within their power to make tangible changes that can alter the industry’s current trajectory.

One possible strategy is to invest in technologies and services like telehealth that keep doctors and nurses focused on what’s most important: treating patients. Providers can use telemedicine to treat patients with conditions that might not be severe enough to warrant an in-person visit, mitigating some of the negative consequences of staffing shortages.

Treating patients over the phone or a video call has also been linked to a reduction in facility operating costs and lower readmission rates. And telehealth and remote patient monitoring devices can also help providers alleviate the administrative burden by helping them easily collect, understand, and share patient data, slashing the time spent entering information or generating reports. For more information about how hospitals are using technology and virtual care delivery systems to compensate for a changing and diminished workforce, listen to episode six of the Definitively Speaking podcast: Reach out and hug someone - Staffing during the Great Resignation, with Tim Bosse from System One.

To confront burnout, hospitals and healthcare facilities can invest time and resources into programs that promote mental and behavioral health through education and training. Perhaps most important is to develop best practices to prevent stigma shaming and suicide. The Dr. Lorna Breen Health Care Provider Protection Act, which became law in March 2022, empowers healthcare entities through awarded grants to tackle these challenges right now.

Lastly, fundamental changes to how Graduate Medical Education (GME) programs work can help the healthcare industry diversify and expand the workforce. These programs are essential to the development of a physician’s knowledge and their ability to provide care. GME training allows physicians to not only stay up to date on the latest medical developments but also contribute to them with their own cutting-edge medical research. However, the availability and capacity of GME programs are capped by Medicare, which can be particularly detrimental to hospitals in rural areas. Raising the cap can help replenish the depleted healthcare workforce and offer providers the additional training they need to be better prepared to respond to the next pandemic.

The past few years have shown the undeniable importance of healthcare workers. While organizations are taking steps to cultivate a positive work environment or reimagine how technology can automate workflows, the battle isn’t over. Resolving the healthcare staffing shortage will require leaders and policymakers to be more ambitious to not only improve the health of patients but also improve the well-being of the hardworking people who serve them.

As healthcare organizations and providers work together to resolve the ongoing staffing shortage, Definitive Healthcare will continue to track and report on the crisis as it evolves in the months to come.

Methodology

Information in this report was gathered and analyzed during July and August 2022, and was updated in July 2023. Data is from a variety of sources, including Definitive Healthcare products. All data points referenced are cited and linked throughout.

U.S. hospital financial information in the HospitalView product is sourced from the Medicare Cost Report. Data is refreshed quarterly, however, it is usually from a time period of about a year in the past. When possible, full-year data is reported.

Healthcare provider information in the PhysicianView product is sourced from the NPI registry, Physician Compare, all-payor claims, and proprietary research. Our teams incorporate updates monthly and currently track more than 2.5 million healthcare providers.

Data from the Atlas All-Payor Claims product is sourced from multiple medical claims clearinghouses in the U.S. and updated monthly. When possible, full calendar year 2022 is used.