Realizing the potential of remote patient monitoring

Explore the unique role of remote patient monitoring (RPM) in the healthcare ecosystem and understand the factors shaping its evolution through a data-focused lens:

- Top RPM procedure claims volumes are up nearly 1,300% since 2019, but only a quarter of providers are actively using the tech

- Primary care physicians, cardiologists, and nephrologists are finding new uses for RPM, even as data security, limited infrastructure, and reimbursement disparities remain top concerns

- Payors, electronic health record vendors, and CMS may hold the keys to send RPM to new heights

We cover these topics and more in our exclusive report. Download your copy and dig into the healthcare intelligence on the technologies, procedures, and diagnoses driving remote patient monitoring.

Take the next step

Definitive Healthcare is the most comprehensive healthcare commercial intelligence platform, delivering insights on every care provider in the U.S.

What’s inside

In this three-part report, we use healthcare commercial intelligence from the Atlas Dataset platform and research from external sources to define remote patient monitoring, understand its position in the healthcare ecosystem and the factors driving its evolution, and consider how to get this game-changing technology into the hands of more providers and patients:

- Part I: Remote patient monitoring today

- Part II: What’s holding RPM back?

- Part III: How to accelerate RPM adoption

Part I: Remote patient monitoring today

What is remote patient monitoring?

Remote patient monitoring is a form of telehealth—or healthcare delivered over a distance, usually via phone or video—in which a provider collects and monitors a patient’s physiologic data remotely using electronic devices. This data may include a patient’s heart rate, blood pressure, blood oxygen level, weight, neurological activity, or any number of other physiologic metrics.

RPM benefits both providers and patients. By equipping patients with the tools to collect their own health data, physicians and other care team members can spend less time performing test procedures and devote more time to analyzing and acting on that data. And in certain circumstances—such as the early days of the COVID-19 pandemic—RPM can reduce the risk of infection to staff and patients.

Patients can reduce their time at the doctor’s office and take greater ownership over their health. For patients with chronic diseases that require routine management, this can mean more independence in everyday life.

RPM devices give both patients and physicians continuous insight into critical biometrics, delivering exponentially more data than one could get through in-office testing alone. This data affords both parties higher-resolution insights into the patient’s health, supporting more informed healthcare decision-making and care planning. When collected and analyzed at larger scales, this data can be employed to guide population health initiatives.

Today, providers and patients have access to all sorts of medical devices designed to collect and transmit data via Wi-Fi, Bluetooth, or cellular signal, including:

- Blood pressure cuffs

- Electrocardiograms (ECGs)

- Glucose monitors

- Implanted pacemakers

- Pulse oximeters

- Scales

- Stethoscopes

- Thermometers

- Wearable heart monitors

The benefits of RPM even extend beyond the scope of provider-patient interactions and day-to-day conveniences. For example, RPM enhances clinical trial recruitment and compliance by making it simple for participants to collect and transmit health data without needing to visit a trial site. Some health systems have even found that RPM can help to reduce hospital readmissions by making it easier to identify and monitor high-risk patients, supporting care transitions, and improving at-home care compliance.

RPM also streamlines other telehealth methods, enabling practices to perform a broader variety of services remotely with greater insight into those services’ impact.

CMS adoption of RPM

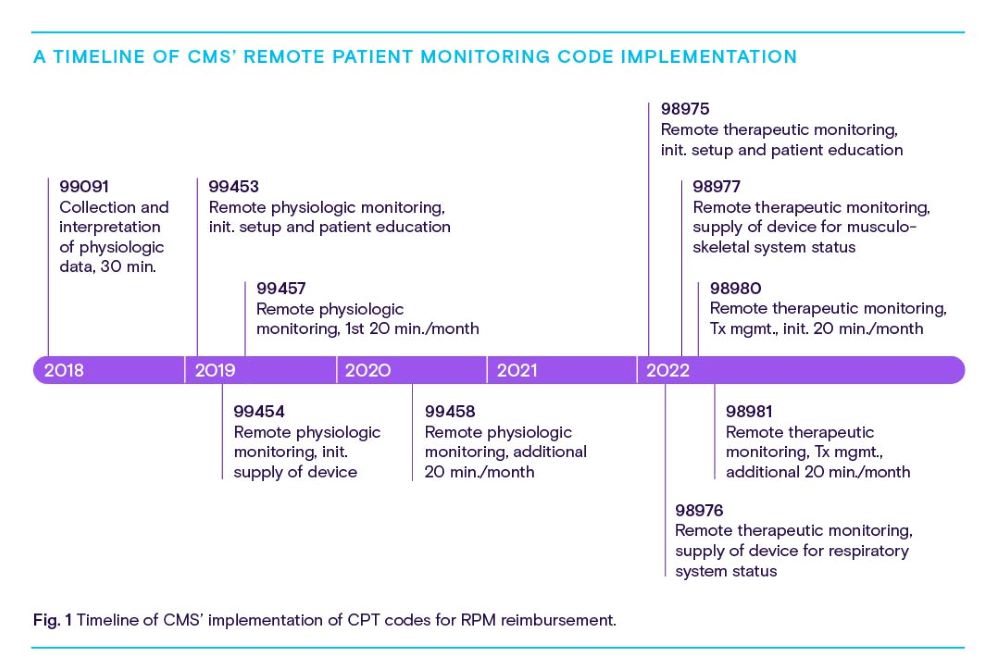

The Centers for Medicare & Medicaid Services formally recognized RPM’s potential value in 2018 by introducing CPT code 99091, a catch-all code for the collection and interpretation of medical information received in digital form. In 2019, CMS added three new codes:

99453 For the setup of remote monitoring equipment and initial patient training

99454 For supplying the patient with RPM equipment and receiving daily recordings/alerts

99457 For monitoring a patient’s remote data and interacting with a patient/ caregiver to adjust the care plan accordingly

CMS added a fourth code, 99458, in 2020 to allow providers to bill for every 20 additional minutes spent monitoring RPM data and working with patients to revise their care plans. In 2022, CMS showed its continued support for RPM by introducing five codes related to remote therapeutic monitoring (RTM). Generally, these codes are used to bill for services involving the collection of non-physiologic data, like respiratory conditions or whether a patient is taking their medication.

Non-governmental organizations have backed RPM, too. In 2022, the American Medical Association published a playbook designed to walk providers through RPM implementation, from identifying a need and forming a team to designing a workflow and partnering with patients, all the way to evaluating success and scaling RPM processes up.

RPM claims on the rise

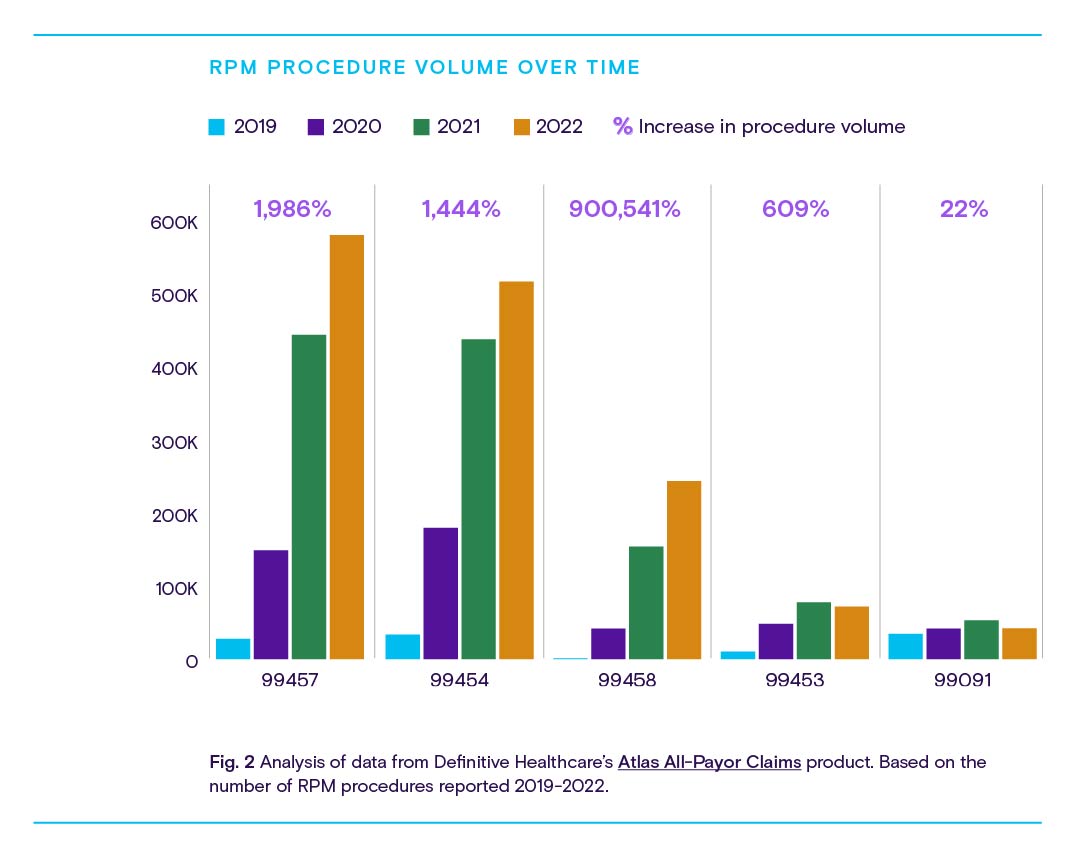

Due to a combination of patient interest, administrative support, and pandemic necessity, RPM seems to be entering its moment. While initial adoption was limited, total claims volumes across these 10 CPT codes skyrocketed by 1,294% from January 2019 through November 2022.

Through 2022 alone, more claims had been filed across all 10 codes than in any other year thus far. By November of that year, RPM claims volumes were already 27% higher than they were through all of 2021. The following chart breaks down these volumes and growth per code.

Fig. 2 shows explosive procedure volume growth across codes for initial device setup and patient education and training, with especially rapid growth from 2020-2021 among codes for initial consultations and 20-minute continuations of those consults.

By November 2022, RPM claims volumes were already 27% higher than they were through all of 2021.

While this trend isn’t especially surprising, it does strengthen the correlation between the pandemic and RPM’s perceived value among healthcare providers. As more widely available vaccines and boosters led to eased restrictions through 2021-2022, RPM growth slowed too—or even reversed, as in the case of codes related to initial patient education and data interpretation.

This slowdown could signal that some patients preferred the in-person care experience, or that some practices stopped offering RPM once office visits were made less risky (a choice possibly driven by higher in-person reimbursement opportunities).

These downward trends might also suggest that providers utilizing RPM hit a point of peak adoption among first-time patients, who now require continuing consultation over the results of their monitoring.

Procedure volume growth alone only reveals so much. To understand what’s driving this growth, we need to ask which providers and patients are using and benefiting from RPM the most.

Who’s using RPM?

From chronic disease management to improving general well-being, providers from every corner of the healthcare ecosystem are finding ways to use RPM.

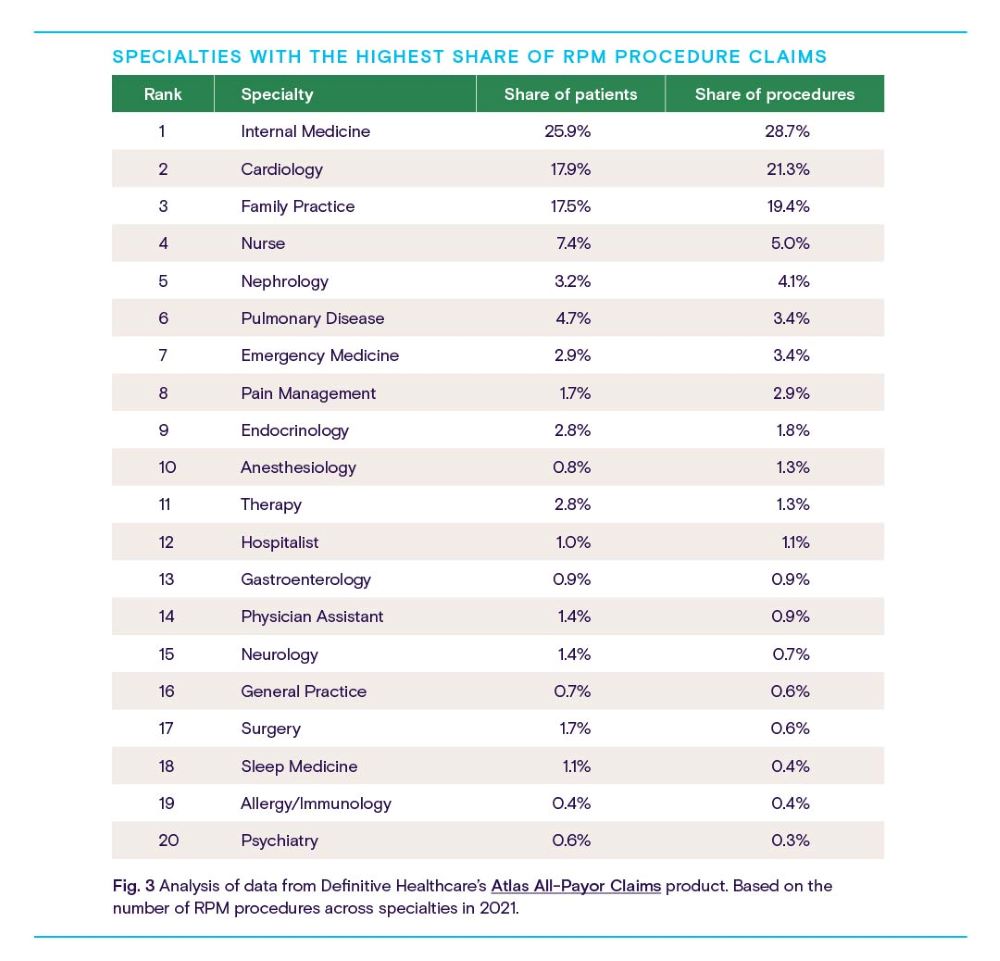

Understandably, the provider specialties with the highest share of RPM procedure claims tend to reflect the most common conditions for which Americans are diagnosed, including essential hypertension (primary care, cardiology), hyperlipidemia (primary care, pulmonology), suspected COVID-19 exposure (primary care, pulmonology), and type 2 diabetes mellitus (primary care, endocrinology).

Cardiologists and primary care providers (including nurses) represent the bulk of current RPM adoption, with nephrologists, pulmonologists, and emergency medicine and pain management specialists taking up smaller but significant portions of the user base.

Heart disease, diabetes, and chronic lung disease are among the most prevalent and deadliest chronic illnesses in the U.S. It’s unsurprising then that specialists who see larger volumes of chronically ill patients with relatively intensive disease management needs are also the top users of RPM. Remote monitoring streamlines the management of these conditions while ensuring a steady flow of accurate health data from patient to provider.

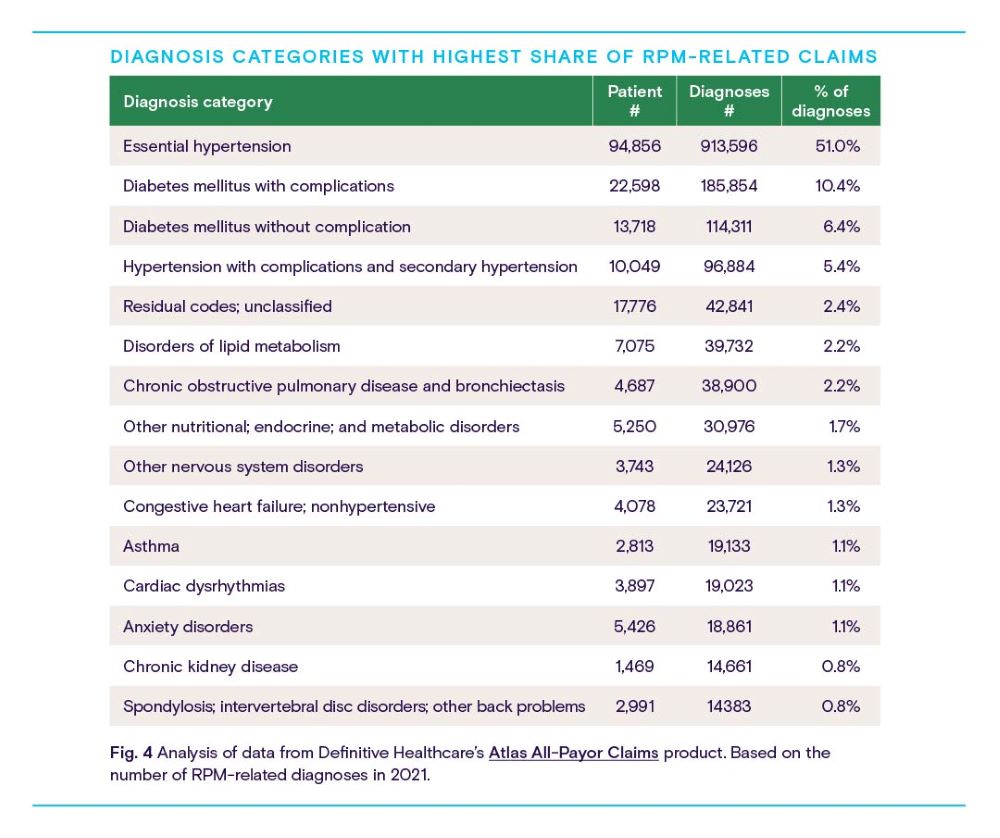

When analyzed by diagnosis category, similar trends emerge.

The most common diagnoses related to RPM fall squarely within the top specialties of Fig. 3: essential hypertension (high blood pressure unrelated to other conditions) and secondary hypertension (caused by another condition) take up the first and fourth positions and represent more than half of all RPM-related diagnoses. Diabetes mellitus with and without complications occupy second and third places on the list, with more than 16% of all diagnoses.

Despite smaller patient populations, providers across nearly every specialty have found applications for RPM—and device manufacturers have been happy to fulfill those needs. To round out the picture of the current RPM market, let’s look at how remote monitoring usage differs across the country.

Where is RPM getting the most use?

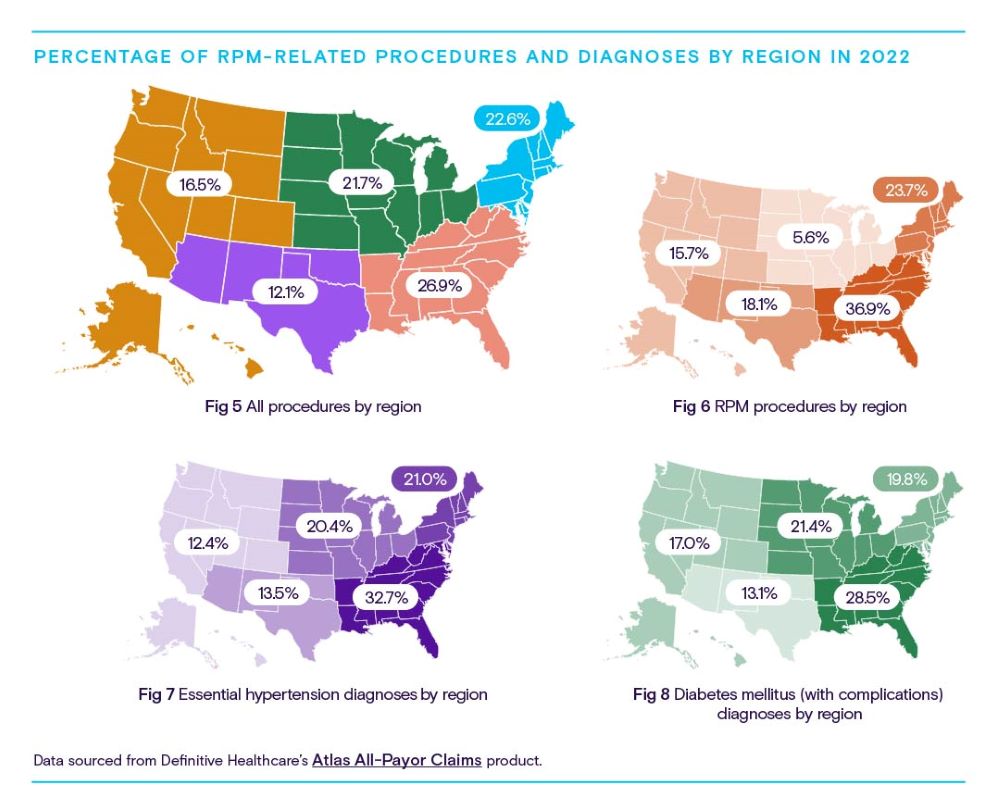

CMS data shows that the prevalence of chronic disease varies from state to state and region to region. Commercial claims data allows us to see where certain RPM-related diagnoses are being made, and where related procedures are performed.

By comparing the following four maps, it’s possible to see how regional RPM procedures and overall procedure volumes compare to claims volumes for the two most common RPM-related diagnosis categories: essential hypertension and diabetes mellitus with complications.

The Southeast is leading the pack in raw RPM usage, representing nearly 37% of all coded procedures. Per capita, the Southeast and Southwest states are the predominant users.

As Figs. 7 and 8 show, the Southeast is also home to the highest volumes of patients with hypertension and diabetes, suggesting both considerable use cases for RPM and a strong correlation between the prevalence of these diseases and RPM usage.

Part II: What’s holding remote patient

monitoring back?

Despite the explosive growth of RPM across the healthcare landscape and its apparent value to providers, patients, and life science developers, the technology is still a long way away from widespread adoption.

Only 25% of healthcare leaders say their practices are currently using RPM, according to an MGMA Stat poll from June 2022.

Only 25% of healthcare leaders say their practices are currently using RPM, according to an MGMA Stat poll from June 2022. Of those respondents, just 23% said they were considering implementing RPM services in the next year.

While that’s a small increase from the 22% who said their practices were using RPM in 2021, it shows that RPM is still far from the norm despite considerable procedure volume growth.

So, what’s holding RPM back? In this section, we’ll consider the factors that may be giving providers pause, including:

- Data security concerns

- Fee-for-service payment models

- Insufficient training and IT infrastructure

- Low reimbursement/unclear reimbursement policies

- Patient-side technology barriers

Data security concerns

Wireless communication technology has become so ubiquitous that the average consumer likely takes their everyday information security for granted. Healthcare providers, however, have an ethical and legal obligation to protect patients’ health information. For some providers, unfamiliarity with RPM technology—or full awareness of wireless transmission’s inherent risks—could limit their willingness to adopt, despite advantages in terms of convenience and access.

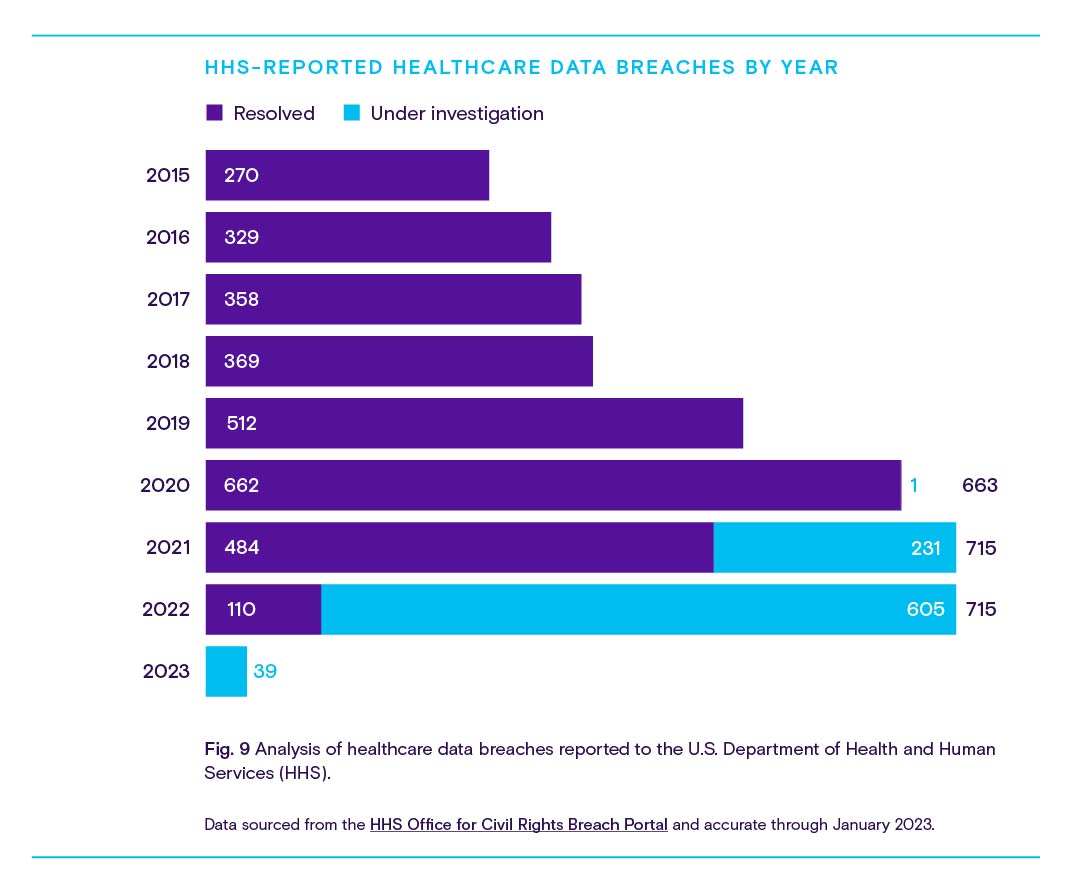

The concerns certainly aren’t unfounded. On average, two major healthcare data breaches happen every day, and the rate of successful breaches seems to be going up.

Luckily for infosec-conscious providers, the National Institute of Standards and Technology published guidance on identifying risks associated with telehealth and RPM, as well as what to look for in potential telehealth platform partners, in February 2022.

Depending on the technology in question, the security of the physical device— and thus the accuracy of the data it transmits—could be a concern as well. While an implanted pacemaker is unlikely to go anywhere without surgical intervention, a Wi-Fi-enabled blood pressure cuff, for example, could be stolen, misplaced, or commandeered by a curious child, leading to inaccurate readings and even clinical trial noncompliance.

Listen to our Definitively Speaking episode with Alan Foreman of B-Secur for an industry leader’s perspective on wearable security.

Fee-for-service payment models

In its current state, the U.S. healthcare system functions by using a blend of fee-for-service and value-based payment models. While most healthcare providers seem to approve of CMS’ shift toward a greater emphasis on value-based care, the reality is that providers rely on revenue streams from both models to stay afloat—and shifting resources toward value-based care usually involves compromising potential revenue from fee-for-service activities.

With benefits like reduced hospital readmissions, fewer emergency room visits, and overall improvements to quality of life and preventive care, RPM is tailor-made to deliver greater value with fewer patient-provider touchpoints. Unfortunately for providers operating in a fee-for-service framework, that means fewer opportunities to bill for services and less revenue.

CMS has sought to bridge the gap by introducing the CPT codes discussed earlier in this report, enabling providers to seek reimbursement for RPM-related tasks like data collection and interpretation, equipment delivery, patient education, and consultations. But some providers balk at the time and data volume restrictions associated with these codes.

To bill for device setup and patient education (CPT code 99453), for instance, a connected RPM device must first transmit 16 days of patient-generated health data. Certain conditions necessitate shorter periods of monitoring, which, under current CMS rules, would not be reimbursable. For this reason, providers seeing patients with more acute medical needs may be dissuaded from considering RPM and instead opt to monitor patients in person, despite the potentially higher long-term costs related to staffing and overhead.

Insufficient training and IT infrastructure

RPM systems and devices come in a variety of forms designed by an equally varied number of manufacturers. Implementing these systems at a medical practice or facility necessitates training—in addition to the continuing medical education that most healthcare professionals are already required to participate in each year.

Unfortunately, that training doesn’t always transfer. Two ECGs from two different device makers may be operated differently, for instance, and any software systems used in tandem with RPM devices will require additional training to ensure accuracy and data security.

While savvy RPM vendors include training and implementation assistance as part of their sales package, some providers may not be convinced that the potential benefits of remote care outweigh its cost in time or resources.

Furthermore, integrating RPM solutions within existing IT systems isn’t always simple. Plenty of third-party vendors offer options to connect RPM tech with electronic health records (EHRs) and care management systems, but organizational decisionmakers may wish to keep these processes in-house, whether to reduce security risks, ease integration with other systems, or simply maintain ownership over the resulting data.

There’s always the possibility that a practice’s IT infrastructure simply isn’t built to effectively use RPM. This may be especially true among cash-strapped rural practices with unreliable internet connectivity or those relying on proprietary software systems.

Low reimbursement, misaligned policies

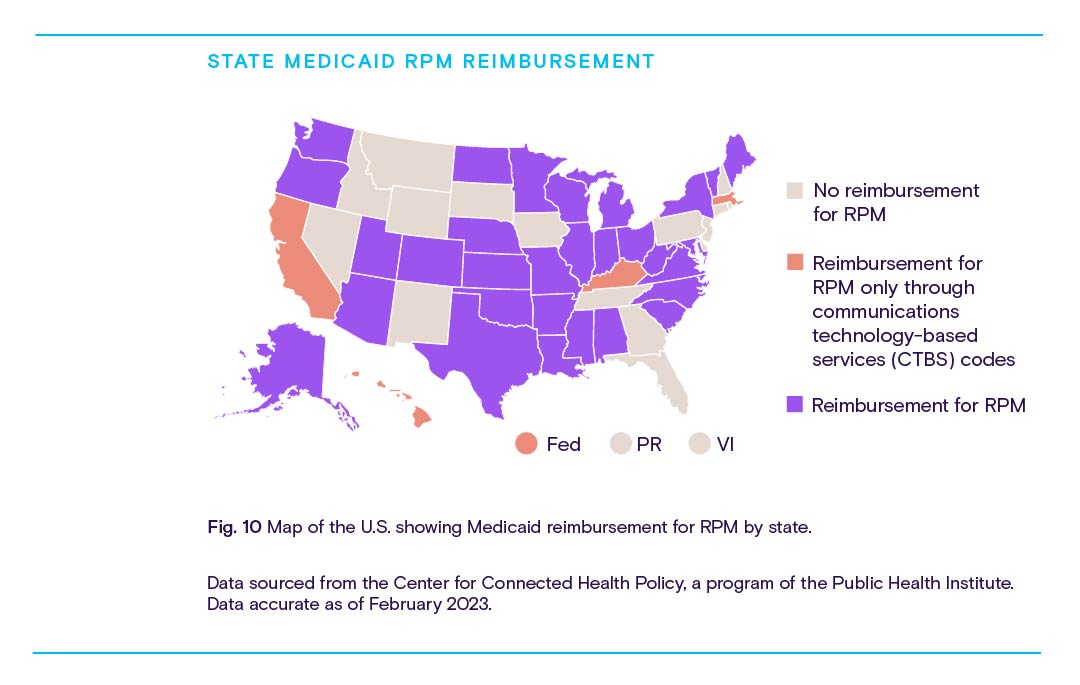

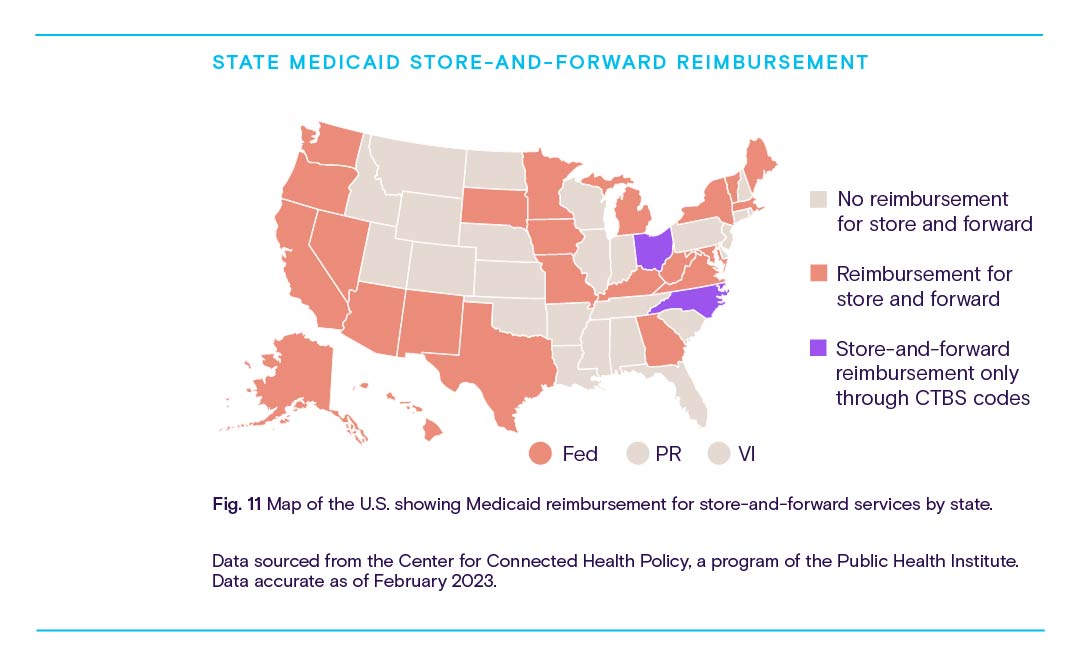

As discussed in Part I, CMS has done its fair share to incentivize RPM over the span of five short years through the implementation of Medicare reimbursement. However, according to the Center for Connected Health Policy, only 34 state Medicaid programs currently reimburse providers for RPM services. In contrast, all 50 state Medicaid programs offer reimbursement for video telehealth services.

These reimbursement policies vary from state to state. Plus, just over 70 private payors reimburse for RPM.

For providers, the calculus behind the profitability of RPM will largely depend on the payor mix of their patient base and the state in which they operate.

That calculus gets even more complex when factoring in reimbursement for asynchronous telehealth or “store-and-forward” services, which involve electronically sending patient data from a primary care provider, technician, or the patient themselves to a specialist for analysis using a secure cloud-based platform.

Store-and-forward services can be used to supplement traditional phone or video telehealth, other RPM services, or in-person care with specialist insights, but the significant disparities in reimbursement from state to state could disincentivize specialists’ participation.

Patient-side technology barriers

In our hyper-connected modern age, it can be easy to forget that technological access isn’t equitably distributed.

Indeed, more Americans than ever own a smartphone (about 85%, according to a 2021 Pew Research Center poll) and over 80% of the country has access to broadband with 100 megabit-per-second download speeds according to the Federal Communications Commission.

However, the latest FCC Broadband Progress Report shows that around 19 million Americans still lack access to high-speed internet. Nearly a quarter of the U.S. rural population and about one-third of people living in tribal jurisdictions don’t have access to these services.

When combined with other factors that disproportionately impact these regions, like poverty and poor health literacy, it can be difficult or impossible to implement effective RPM strategies. Furthermore, providers serving these areas tend to be cash-strapped themselves, operating on shoestring budgets and skeleton crews to deliver care over sprawling acres.

While rural regions and practices present some of the best use cases for RPM’s benefits, patients and providers are unfortunately left to contend with financial and technological realities that disincentivize investment and positive change: lack of existing infrastructure, low population density (and thus limited patient base), and reduced private payor presence.

Part III: How to accelerate the adoption

of remote patient monitoring

The challenges facing remote patient monitoring are, in many cases, systemic. By and large, they’re indicative of a healthcare system that has yet to adapt to its own rapidly evolving technological capabilities and the shifting needs and preferences of its constituents.

To at least some degree, the systemic nature of these challenges mandates further intervention at the highest levels of the healthcare system. New regulations, reimbursement programs, and other incentives implemented by CMS and other governing bodies could help to speed up the adoption of RPM services, while making existing services more effective.

However, there are still plenty of opportunities for innovative and enterprising organizations to step in with market-based solutions. And there are plenty of reasons to do so:

- RPM implementation has been shown to reduce readmissions, improving hospital performance metrics and reducing costs to providers and payors

- RPM services offer additional opportunities for reimbursement and referrals, raising net patient revenue for providers

- Patients can use RPM to keep a closer eye on their health and well-being, helping them stay out of the hospital and reducing household medical expenses

- RPM improves access to care (especially in rural and underserved regions), encourages greater patient engagement, and gives patients more flexibility in their care, boosting overall satisfaction

- RPM reduces the need for in-person patient touchpoints, reducing the strain on overburdened staff and limiting the spread of infectious disease

This section will examine how governmental and private entities could address RPM’s existing obstacles and pave the way for a brighter future.

Integrate RPM management into electronic health record systems

Electronic health records are digital representations of patients’ charts, containing information on demographics, medical history, diagnoses, test results, and medical imaging. EHRs simplify and secure the capture, storage, and transmission of medical information. Under current CMS guidelines, providers that don’t employ EHRs receive docked reimbursement for Medicare claims.

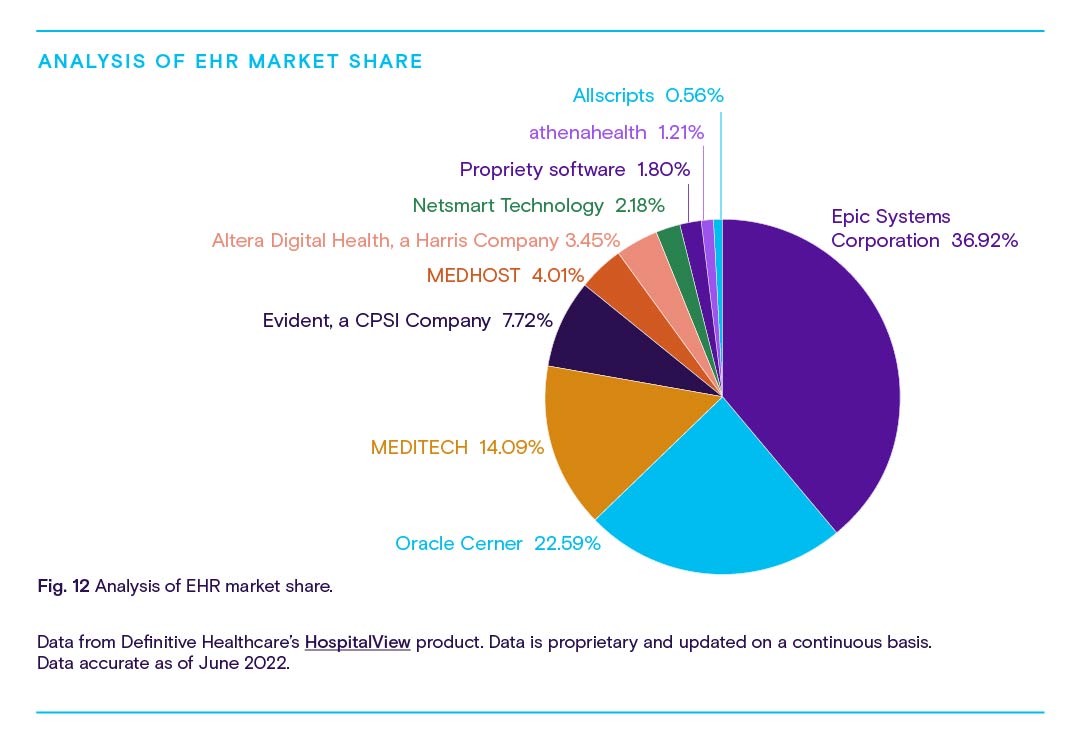

According to the Office of the National Coordinator for Health Information Technology, about 88% of providers were using EHRs as of 2021, with 78% using EHR systems certified by the Department of Health and Human Services. While many EHR developers have added telehealth-related functionality to their software offerings, most EHRs do not currently offer native RPM integration, requiring providers to either manually enter RPM data into their EHRs—often with the additional requirement of custom-built templates to accommodate the information— or turn to third-party vendors for software that can bridge the gap between RPM and EHR systems.

The extra work, training, and expense necessary to integrate RPM data into existing EHRs might disincentivize providers from adopting this useful technology. While the situation represents an opportunity for software and IT developers to create gap-bridging solutions, there’s just as much opportunity for major EHR companies to add native RPM integration to their platforms.

As shown in Fig. 11, nearly three-quarters of providers rely on one of three major EHR platforms from Epic Systems Corporation, Oracle Cerner, and MEDITECH. It’s not hard to imagine one of these organizations upgrading their platforms with native RPM capabilities to claim a huge competitive advantage, potentially reshaping the market while drastically reducing barriers to RPM implementation.

Pilot new RPM tech and use cases in the private sector

While the government tends to move slowly on matters related to healthcare reimbursement and incentivization, private payors are better equipped to jump at opportunities for increased revenue, including through the implementation of new RPM policies and programs.

Massive payors like Cigna, Humana, and UnitedHealthcare have already launched RPM pilot programs to incentivize the technology’s usage…

Massive payors like Cigna, Humana, and UnitedHealthcare have already launched RPM pilot programs to incentivize the technology’s usage among partnering providers, and many more offer reimbursement to providers who already utilize RPM in their practices.

As patients continue to call for care and health management capabilities at home, and existing RPM programs demonstrate their cost-saving benefits, it’s almost certain that more and more private payors will begin reimbursing for RPM services. But there’s opportunity here for insurance companies to break new ground and bring new tech onto the market.

For instance, payors might incentivize RPM in the psychiatric and counseling space by reimbursing providers who enable their patients to report on their daily mental health through an encrypted web portal or similar system.

In geriatric care, some patients already utilize pill boxes that issue daily reminders and send remote notifications to loved ones or caregivers when the day’s medication hasn’t been accessed. Private payors could amplify this tech by paying doctors to prescribe it and train patients and family members on its usage.

The possibilities are practically endless: provider usage of metrics from consumer wearables like FitBits or Apple Watches, remote breathalyzer testing for patients seeking addiction treatment, even at-home recovery tracking for sports injury patients—CMS may be slow to incentivize practices with narrower use cases like these, but private payors can seize potential profits by getting ahead of the curve.

Streamline the process with automation and AI

It can be a chore for care teams to take on additional data entry or train with new devices and software systems. With automation powered by artificial intelligence (AI) and machine learning (ML), providers can let computers handle the heavy lifting around data entry, analysis, and care guidance related to RPM.

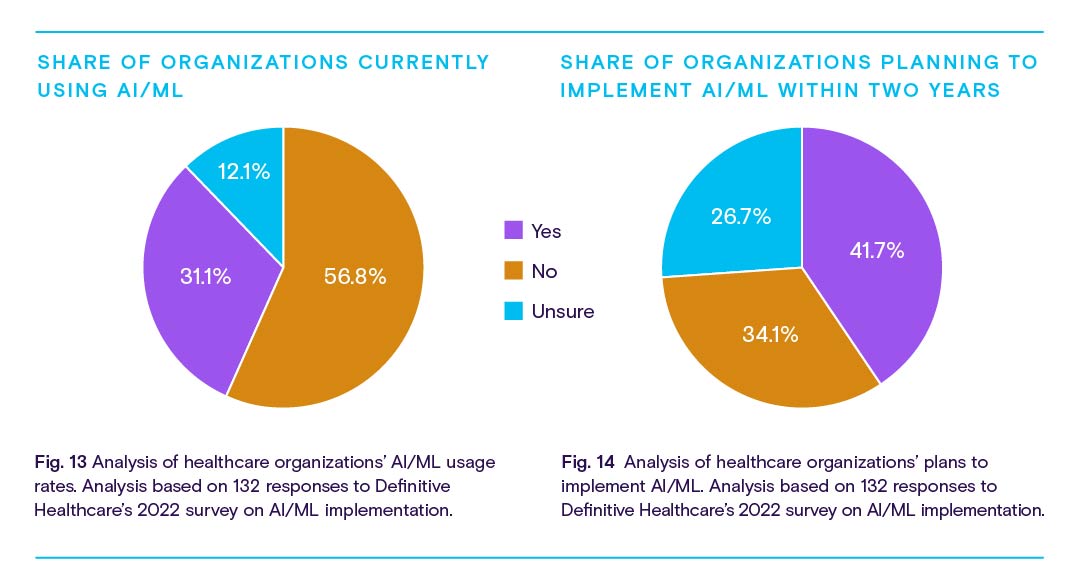

AI/ML technology is already used to analyze medical imaging, diagnose and prognosticate certain diseases, and identify the most suitable treatments for conditions with highly specific genetic indications.

However, as with RPM, adoption is relatively low. Less than a third of healthcare organizations currently use AI/ML or deep learning technology to assist with tasks related to patient care, monitoring, imaging, diagnostics, or business operations, according to a 2022 poll by Definitive Healthcare. That figure is set to grow, with 41.7% planning to implement AI/ML within the next two years.

In the future, AI/ML could be employed to process RPM data and verify accuracy, identify and analyze anomalous readings, recommend care plan changes, and even alert patients and family members to potential concerns before a human doctor could feasibly do so.

Of course, while AI/ML present a beneficial partner to RPM technology, the barriers to organizational adoption are likely similar between both: cost, lack of strategic direction, and inadequate IT infrastructure were the most listed hurdles among 132 poll respondents. But for those organizations able to effectively implement it, AI/ML could save time, money, and training requirements associated with RPM.

Remote patient monitoring could be your next big break

The fundamentals of healthcare are changing, and remote patient monitoring is no small part of that change. In just a few years since its recognition by CMS, RPM has already made a big impression on the healthcare market. RPM-related claims volumes are up nearly 12x from 2019. Awareness and adoption rates are up, too, and it’s not hard to see why.

For patients living with chronic diseases, limited mobility, or reduced access to traditional care settings, RPM is a potential life-changer. Even for the average person in generally good health, RPM is valuable as a preventive care measure, delivering real-time, high-resolution insights into one’s personal well-being.

Providers should leverage RPM to meet these needs and reap a variety of associated benefits: to increase their avenues for reimbursement, reduce staffing burdens, cut costs associated with overhead, and improve performance metrics. Developers and vendors can speak to these benefits as they support providers with RPM integration solutions, infrastructure upgrades, and RPM devices themselves. And payors can attract both patients and providers by expanding reimbursement around RPM services.

At every level, from patients and providers to facilities and entire networks, RPM adoption offers measurable gains. This technology represents a massive opportunity, and the market should treat it as such.

… CMS has only issued 10 procedure codes related to RPM—a far cry from the 250+ codes it lists for other telehealth services.

Of course, that doesn’t mean there aren’t challenges to overcome.

Despite massive growth since 2019, only a quarter of healthcare providers currently offer RPM services. And CMS has only issued 10 procedure codes related to RPM—a far cry from the 250+ codes it lists for other telehealth services.

Providers are mostly using RPM to assist in the management of prevalent chronic illnesses like heart disease and diabetes, but some specialists are finding ways to use RPM to treat lung disease, neurological conditions, and mood disorders, among many other conditions.

The factors keeping RPM from wider adoption are probably what you’d expect around any technology that transmits private patient data: security concerns, unfamiliarity on the part of both patients and providers, and lack of technical capability and infrastructure at a variety of scales.

CMS and private payors alike can address some of this hesitation and encourage further growth by introducing new opportunities for reimbursement and implementing programs that put RPM in doctors’ and patients’ hands.

For developers of RPM tech, EHR systems, and other healthcare IT solutions, the future is full of opportunities. Integration, automation, and overall simplification are the keywords here. Providers want to focus on providing care, and their patients want ownership over their own well-being with as little technological friction as possible.

RPM is already delivering on its potential, but it’s up to the industry and public sector to bring the technology to the next level. With the right data and a keen understanding of the healthcare landscape, there’s space for organizations to capitalize on the promise of RPM and drive the next big advancement in this exciting space.

Methodology

Information in this report was gathered and analyzed between December 2022 and January 2023. Data is from a variety of sources, including Definitive Healthcare products. All data points referenced are cited and linked throughout.

Healthcare provider information in the PhysicianView product is sourced from the NPI registry, Physician Compare, all-payor claims, and proprietary research. Our teams incorporate updates monthly and currently track more than 2.5 million healthcare providers.

Data from the Atlas All-Payor Claims product is sourced from multiple medical claims clearinghouses in the U.S. and updated monthly. When possible full calendar year 2021 is used.