Retailers in healthcare: A catalyst for provider evolution

Retail health clinics are no longer an experiment of a few grocery stores, convenience stores, or superstores – they’re becoming a major force in the U.S. healthcare system. In this Definitive Healthcare report, we explore how drugstore chains like CVS to big-box stores like Walmart want to change how patients consume healthcare, using retail clinics as a vehicle, and examine:

- Why retail clinic claims volumes are up 200% since 2017, outpacing growth in urgent centers, emergency departments, and physician practices.

- The implications for patients and traditional healthcare providers.

- How traditional providers can thrive in a consumer-driven landscape.

We cover these topics and more in our exclusive report. Download your copy for our data-driven perspective on the current trends in the retail clinic landscape and the opportunities these new market entrants present.

Take the next step

Definitive Healthcare is the most comprehensive healthcare commercial intelligence platform, delivering insights on every care provider in the U.S.

What’s inside

In this report, we use healthcare commercial intelligence from the Definitive Healthcare platform and research from external sources to understand the rising role of retailers in healthcare, explore the impact of retail clinics on patients and traditional healthcare providers, and consider how traditional providers should respond to these new entrants.

This report is divided into three parts:

- Part I:Retailers in healthcare today

- Part II:What are the implications for patients and providers?

- Part III:How traditional healthcare providers should respond

With this report, healthcare organizations can gain greater insight into the role of retail clinics in the broader healthcare landscape as well as the challenges and opportunities these new market entrants present. In addition, healthcare providers can use this report as a tool to inform their strategic planning and position their organizations for success in a changing landscape.

Part I: Retailers in healthcare today

Retailers have been testing out care delivery models with in-store health clinics for two decades. These medical clinics, located in drugstores, supermarkets, and other retail settings, got their start providing convenient access to affordable, nonemergency care for a limited range of health conditions, including minor illnesses like ear infections. Care is delivered by a nurse practitioner or a physician assistant. With extended weekend and evening hours and walk-in appointments, retail clinics offer a level of convenience that traditional doctor’s offices usually can’t match.

As the healthcare industry shifts toward more consumer-centered care, retailers are increasing their investments in these clinics, turning them into hubs for more comprehensive care delivery. The last few years have seen retailers make billion-dollar moves to expand their services beyond acute care and dive deeper into primary care and chronic disease management. A Bain & Company report predicts new primary care models from nontraditional players, such as retailers, could capture as much as a third of the U.S. primary care market by 2030.

In this part of the report, we’ll paint a picture of the national retail clinic landscape, including the proliferation and scope of retail clinics, and highlight recent trends in use, covering:

- Why big retailers are jumping into healthcare

- The retailers leading the charge

- Most clinics operate in large metropolitan areas

- Retail clinic claims are on the rise

- Retail clinics’ role in acute care and chronic conditions

Why big retailers are jumping into healthcare

Rising out-of-pocket healthcare costs, combined with increasing demand from patients for convenient healthcare options, have created a demand for alternative sites of care. According to Kaiser Family Foundation, out-of-pocket spending increased 35% since 2010, averaging $1,315 per person in 2021. Out-of-pocket spending refers to direct spending by consumers for healthcare, including copayments, deductibles, and coinsurance, but excluding the amount paid toward health insurance premiums.

Retailers also recognize the potential to leverage their brand recognition and immense customer base to expand into healthcare…

Retailers are stepping in to fill the demand for more costeffective care, offering self-pay options with transparent and fixed pricing, and are well positioned to meet the preference for convenience with their existing physical locations, thanks to their thousands of stores. These efforts to bring more affordable healthcare to the communities they serve also align with retailers’ existing efforts as discount superstores, enhancing their brand value.

Retailers also recognize the potential to leverage their brand recognition and immense customer base to expand into healthcare, which is a massive and growing market. In 2021, the U.S. spent $4.3 trillion on healthcare, or about $13,000 for every American. By entering this industry, retailers can tap into a new source of revenue, reducing their reliance on traditional retail sales and shifting their strategy from products to services as more brick-and-mortar retail transactions move online.

For pharmacy giants like CVS and Walgreens, investing in clinics is also a way to boost prescription drug sales. Recent expansions into new services, like chronic disease care, could also help diversify patient mix and offset declines that might come from competitors in an increasingly crowded market, such as urgent care centers and direct-to-consumer telemedicine.

The retailers leading the charge

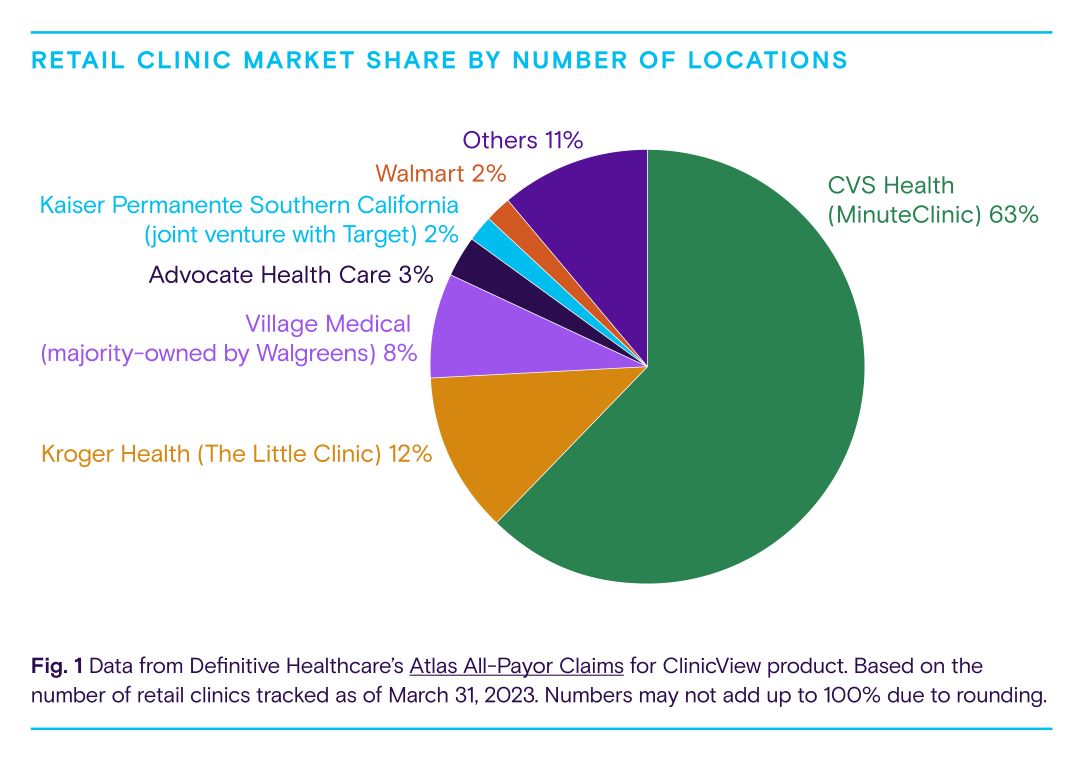

Most retail clinics (85%) are owned by large retail chains such as CVS, Walgreens, and Walmart. However, there has been a trend in recent years toward hospitals and health systems entering the retail clinic landscape by partnering with chains to support the growing demand for consumer-centric healthcare. Kaiser Permanente’s partnership with Target is an example of this model. The chart below shows the key players in the retail clinic space based on share of clinics.

Ninety percent of retail clinics are owned by six organizations. Pharmacy giant CVS is the biggest player in the nation, with more than half of all retail clinic sites. The company, which also owns a payor (Aetna) and pharmacy-benefits manager (Caremark), entered the retail clinic market when it acquired MinuteClinic, founded as QuickMedx, in 2006. Today, CVS also operates enhanced retail clinics called HealthHUBs that focus on chronic disease management. The company is doubling down on primary care with the acquisition of Oak Street Health, which has a network of clinics for seniors on Medicare, and has also acquired in-home assessment company Signify Health.

Supermarket giant Kroger Health is the second-largest operator through its Little Clinic business, which it acquired in 2010. The grocery giant has more than 220 retail clinics in 35 states. Kroger has laid out a vision of keeping customers healthy through “food as medicine” offerings, like telenutrition, food prescriptions, and nutritional scoring with the goal of preventing disease.

Third-largest retail clinic player Walgreens is shifting its strategy from partnering with healthcare providers to owning them, increasing its stake in primary care clinic chain VillageMD. The company plans to open 1,000 co-located primary care practices by 2027, with more than half in underserved communities. Unlike many retail clinics, this venture focuses primarily on the use of physician providers who are integrated with pharmacists, nurse practitioners, and social workers.

Walmart is another big player in the retail clinic space. Walmart Health is the company’s latest iteration of the retail clinic model over the past 15 years. Marketing itself as a primary care clinic, Walmart is making a push to double its footprint of in-store clinics. It also offers a co-branded health plan in a handful of counties in Georgia with Walmart Health clinics.

Other prominent retailers making meaningful moves in healthcare include Amazon, Best Buy, and Dollar General. While Amazon lacks brick-and-mortar retail clinics, the company is pushing a consumer experience driven with digital health products, and it recently acquired One Medical, a membership-based primary care group with about 125 primary care offices nationwide. Meanwhile, Dollar General is partnering with DocGO to pilot mobile clinics, and Best Buy is providing technology to support in-home hospital care.

To round out the picture of the current retail clinic landscape, let’s look at geographic trends and clinic usage.

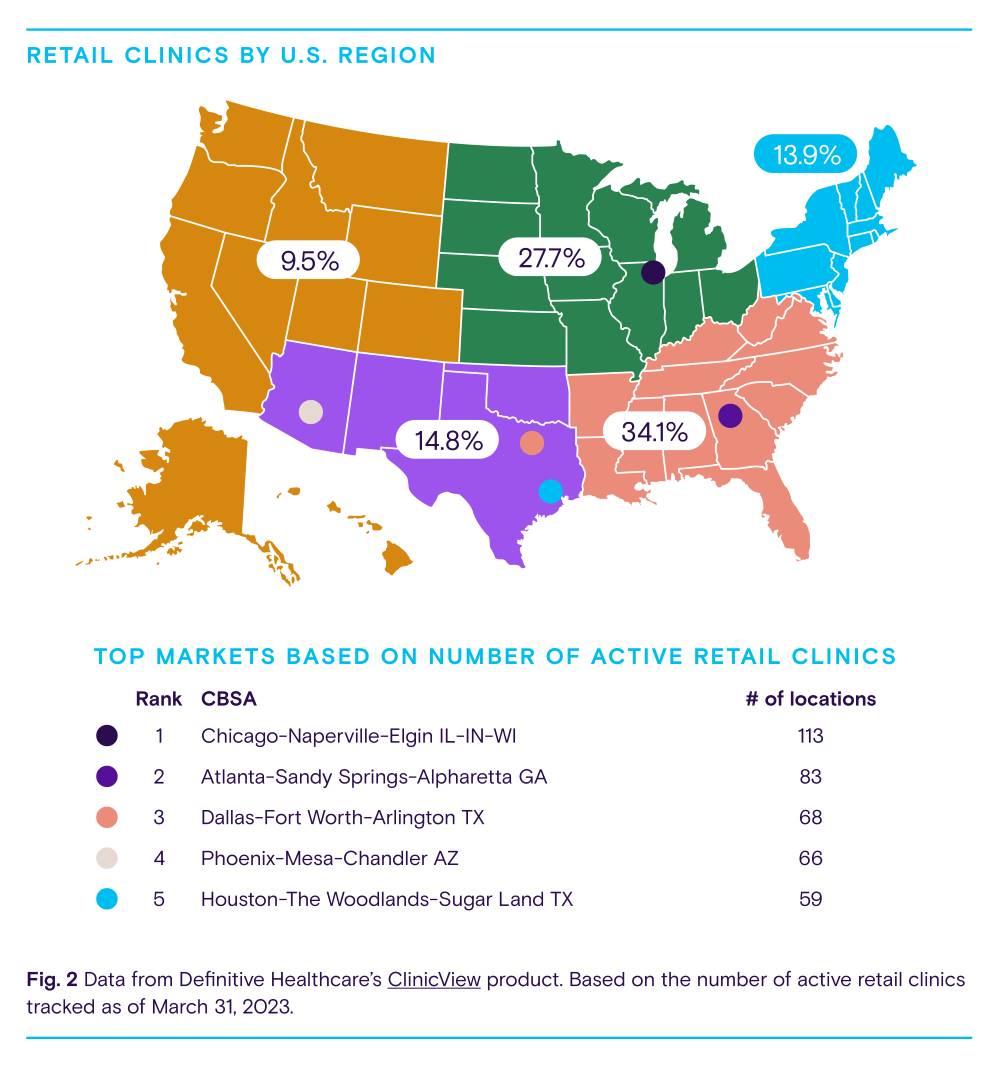

Most retail clinics operate in large metropolitan areas

In 2023, there were more than 1,800 active retail clinics in 44 states. These clinics were more likely to be located in major metropolitan areas. Only about 2% of clinics were in rural areas, half of which were owned by CVS. For the same reasons healthcare providers often don’t locate in these communities, such as workforce challenges due to low populations, retailers are likewise reluctant to open clinics in rural areas.

As Fig. 2 shows, most retail clinics are in the Southeast and the Midwest, which account for 62% of locations. Nearly half (49.1%) of all retail clinics are concentrated in seven states: Texas, Florida, Ohio, California, Georgia, Illinois, and Tennessee. One reason for this is population density. These states are some of the most populous in the country. This makes sense from a business perspective as retailers want to reach as many customers as possible. Metropolitan areas with the highest numbers of retail clinics include Chicago, Illinois; Atlanta, Georgia; Dallas, Texas; Phoenix, Arizona; and Houston, Texas.

Retail clinic claims are on the rise

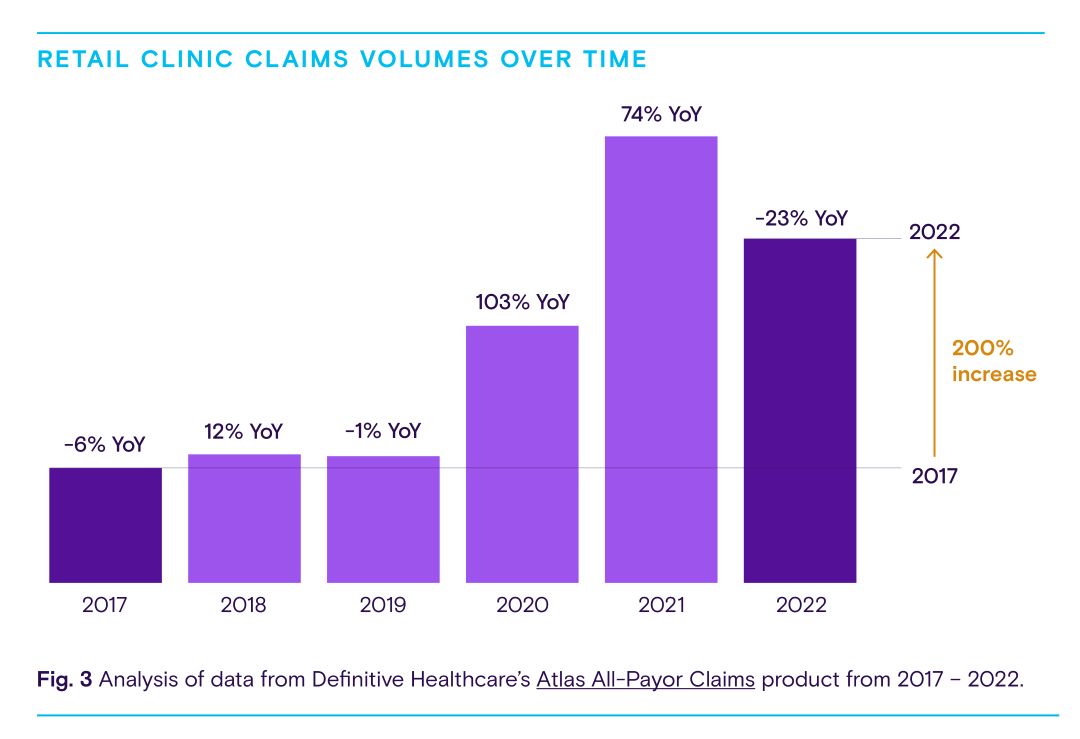

As retailers race to build out their medical clinics across the country, consumers are flocking in. According to all-payor claims data, retail clinics saw the largest percentage increase in utilization among traditional and alternative care sites — including urgent care centers, primary care practices, and emergency rooms (ERs) — since 2017.

Retail clinic claims volumes grew 200% from 2017 through 2022. Over the same period, urgent care claims climbed 70% while hospital ER claims decreased 1% and primary care physician claims dropped 13%.

Retail clinic claims volumes grew 200% from 2017 through 2022, mainly due to high usage during the pandemic. For comparison, over the same 5-year period, urgent care claims volumes climbed 70% while hospital ER claims volumes decreased 1% and primary care physician claims volumes dropped 13%.

Retail clinics outpaced other sites of care in large part because the federal government made national retail pharmacies, including stores like CVS and Walgreens, a key part of its COVID-19 vaccination strategy, and more people became comfortable with receiving vaccinations and getting tested for COVID-19 at these clinics. Federally purchased COVID-19 vaccines, including boosters, were free to everyone in the U.S., regardless of insurance coverage.

As vaccination coverage increased across the U.S., overall retail clinic use declined from 2021 to 2022. However, by excluding COVID-19-related procedures, such as SARS-CoV-2 antigen testing, we can see retail clinic claims volumes were still up by 21% from 2021-2022.

Claims volume growth only reveals so much. To understand what’s driving this growth, we need to understand what retail clinics are treating.

Retail clinics role in acute care and chronic conditions

Retail clinics got their start providing convenient access to basic, nonemergent care for a limited range of health conditions, from minor illnesses and injuries to preventive care like vaccinations and physical exams. Increasingly, retailers are expanding their scope of services beyond acute care to differentiate themselves in a crowded market. Many are investing in primary care, chronic disease management, and even behavioral health. By using all-payor claims data, we can gain a better understanding of the types of conditions retail clinics are treating.

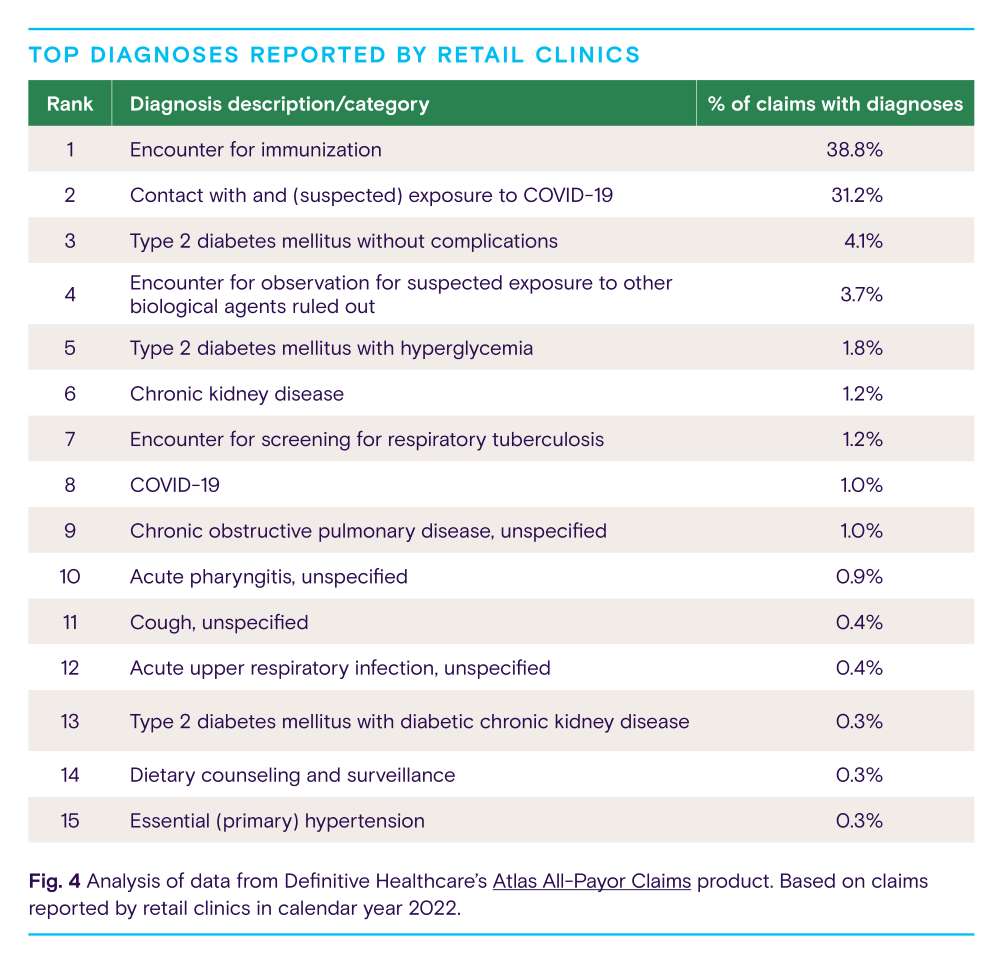

Understandably, encounter for immunization (38.8%) was the most common diagnosis in retail clinics in 2022. Last year, public health officials continued to encourage vaccination and emphasize the importance of booster shots to help prevent serious illness and death from COVID-19. Prior to the pandemic, an estimated 50,000 U.S. adults died annually from diseases that could be prevented by vaccines, highlighting the value of the kind of care retail clinics provide.

Encounter for immunization was followed by contact with and exposure to COVID-19 (31.2%) and type 2 diabetes without complications (4.1%). Together, these three clinical issues comprised nearly three-quarters of diagnoses reported by retail clinics. Other common diagnoses included sore throat, cough, and upper respiratory infection.

About one in 10 diagnoses at retail clinics were related to chronic conditions, including diabetes, chronic obstructive pulmonary disease, kidney disease, and hypertension, showing that people are turning to retail clinics for more than just the common cold and vaccines. With more than six in 10 adults in the U.S. living with a chronic condition, the opportunity for retail clinics to become meaningful players in chronic disease care is vast, especially as retailers evolve clinic offerings from episodic treatment to primary care.

Many retail clinics treating chronic diseases were physician-led, like Walgreens-backed Village Medical, or health system-owned, such as Advocate Health at Walgreens. Given the expertise of health systems and physicians in managing complex patients and conditions, as well as the trust in traditional healthcare providers for chronic and specialty care, it’s not surprising that retail clinics managing these diseases have strong collaborations with traditional healthcare providers.

As free COVID-19 tests and vaccinations are phased out, we expect the growth rate of retail clinic use to slow down. However, retail clinics will continue to play an important role in healthcare delivery, especially as retailers branch out to offer a wider range of services, from chronic disease management and primary care to mental health and wellness programs.

Part II: What are the implications for patients and providers?

The explosive growth of retail clinics presents a host of both opportunities and potential challenges. For patients, retail clinics offer a cost-effective and convenient alternative to conventional healthcare settings such as physician offices. Retail clinics are also promoted as a solution to low-income areas that lack access to medical resources. At the same time, provider groups have raised concerns about quality-of-care issues and the disruption of established patient-physician relationships. In this section, we’ll explore the potential impact of these new market entrants on patients and traditional healthcare providers, such as:

- More affordable care at lower costs

- Breaking down barriers to access

- Fewer trips to the ER

- More fragmented care but high quality

More affordable care at lower costs

About half of U.S. adults say they have difficulty affording healthcare costs, according to Kaiser Family Foundation. Uninsured adults are more likely to report this, although those with health insurance are not immune to high healthcare costs, which can prevent people from seeking needed care.

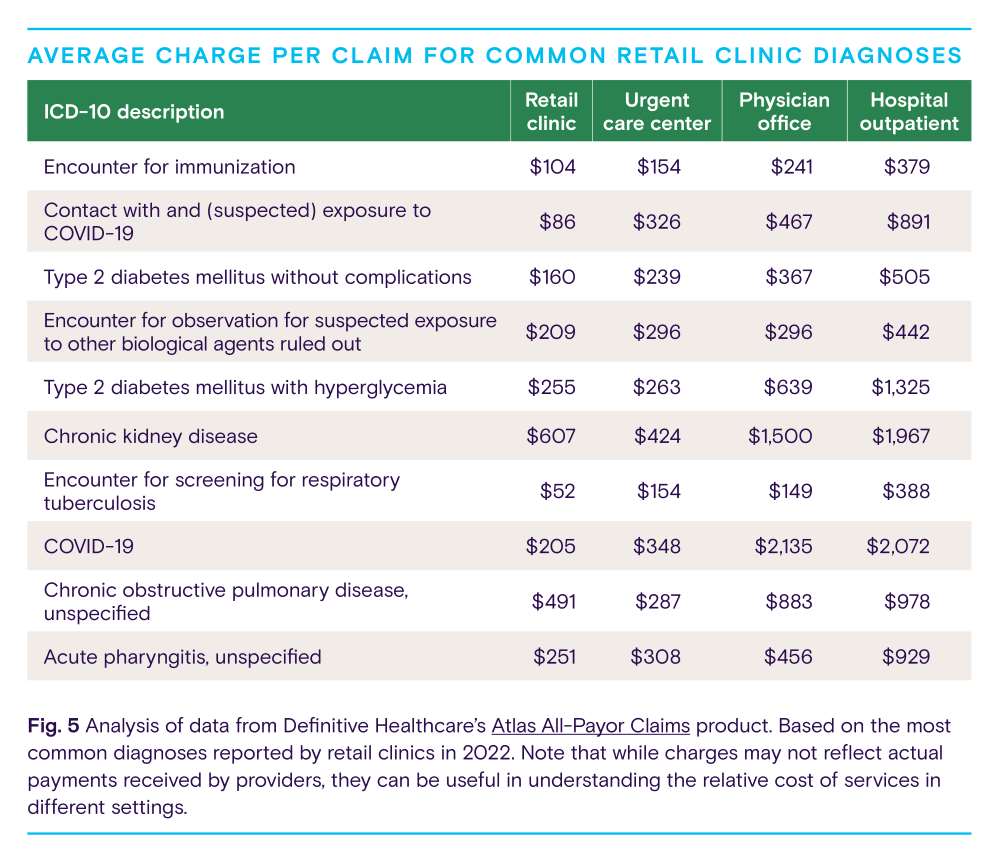

For the 10 most common diagnoses, the average charge per claim on aggregate was $38 less than claims submitted by urgent care centers, $471 less than claims submitted by physician offices, and $746 less than claims submitted by hospitals.

For example, the recent growth in the prevalence of high-deductible health plans (HDHPs) has created more sensitivity to out-ofpocket costs for many insured people.

Retail clinics have long been viewed as an antidote to more expensive care settings, such as physician offices and emergency departments. Using all-payor claims data from our Atlas Dataset, we can see how much retailers are billing for certain diagnoses relative to other care settings. The table below summarizes the average charge per claim for common diagnoses across outpatient care settings.

Based on an analysis of the most common diagnoses reported by retail clinics, retailers deliver care at a significantly lower cost than other sites of care. For the 10 most common diagnoses, the average charge per claim on aggregate was $38 less than claims submitted by urgent care centers, $471 less than claims submitted by physician offices, and $746 less than claims submitted by hospitals. About two-thirds of retail clinic visits are paid for with health insurance, so these findings suggest considerable savings for payors.

For uninsured patients, retail clinics offer a menu of services with transparent and fixed pricing, and services typically cost less than the same services offered in urgent care centers, physician offices, and emergency rooms. For example, prices for most services at the largest retail clinic operator (MinuteClinic), from illnesses and infections to tests, screening, and physicals, ranged from $99-$139 in 2022. These clinics can provide more cost-effective care because they use less expensive providers such as nurse practitioners and physician assistants, deliver care in smaller settings, and generally focus on low-acuity conditions.

While retail clinics provide care that costs less than other settings, some studies suggest retail clinics could drive up overall healthcare spending by complementing physician care instead of replacing it, generating new medical visits that patients might not have otherwise pursued. While these added visits could have long-term health benefits, the ability of retail clinics to impact overall healthcare spending is unclear.

As more consumers adopt alternative care sites, it will be important to educate consumers on the appropriate use of retail clinics to prevent the overuse of services.

Breaking down barriers to access

Although demand for healthcare services is expanding with the growth and aging of the U.S. populace, the country’s access to primary care physicians does not appear to be keeping pace with service needs. According to federal data, the U.S. could see a shortage of about 14,000 primary care physicians by 2035. Moreover, the typical wait time for a primary care provider was 26 days last year.

Quick-access clinics like retail clinics, which are typically staffed by advanced practitioners, can be one part of the solution to improving access to basic healthcare, providing a stop-gap measure for the growing physician shortage. About one-third of the U.S. urban population already lives within a 10-minute driving distance from a retail clinic.

…the unequal distribution of retail clinics across neighborhoods presents a challenge.

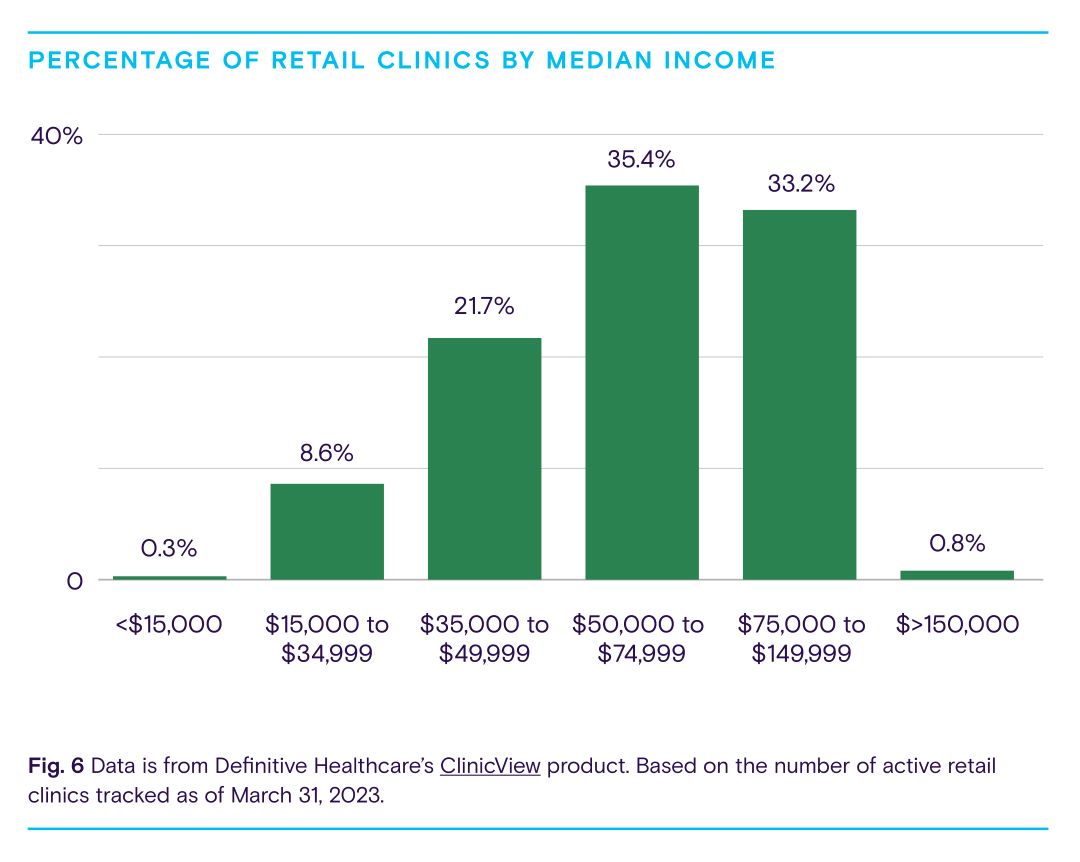

Supporters of the retail clinic model have long touted their ability to improve access to healthcare, particularly among certain disadvantaged groups, including low-income populations and those with little access to primary care physicians. However, the unequal distribution of retail clinics across neighborhoods presents a challenge.

As described earlier, few retail clinics operate in rural areas. Yet rural areas tend to have fewer healthcare providers, including physicians, advanced practice providers, and other healthcare workers. The population is generally older and sicker and fewer people have health insurance compared to urban communities, meaning rural areas could benefit the most from retail clinics.

Most retail clinics operate in geographic areas with higher median incomes, in part to attract — or respond to demand from — a more affluent-patient mix. Additionally, areas with retail clinics tend to have higher concentrations of white residents, fewer Black and Hispanic residents, and fewer people living in poverty compared to the national average.

While retail clinics are indeed widespread and easily accessible to large swaths of the population, these clinics do not currently appear to be improving access to care for underserved populations, since most retail clinics are not preferentially located in underserved communities. If retail clinics are to be part of the solution to provider shortages in underserved communities, they will need to open their doors in these communities.

Fewer trips to the ER

Due to barriers to access, like long wait times and limited after-hours care at physician offices, U.S. patients seek a significant amount of non-emergent care at emergency departments (ED), which can lead to overcrowding and excessive healthcare spending. One study estimates between 13.7% and 27.1% of all ED visits, or up to 1 in 4 visits, could be treated at alternative care sites, freeing up hospital resources for more urgent medical conditions and reducing ED wait times.

At least one study found retail clinics reduce emergency room use by 3-13% for preventable conditions and 6-12% for minor acute conditions among local residents — a promising finding for health systems and hospitals, given the increasing demand for healthcare services and the growing physician shortage. By diverting patients to retail clinics for non-emergency care, providers at health systems and hospitals can direct resources toward patients most in need.

More fragmented care but high quality

Despite their apparent value to many patients, retail clinics have also generated controversy. A major criticism of retail clinics by traditional providers is that they lead to fragmentation of care and erode relationships between patients and primary care physicians, once considered central to care coordination. Some physicians worry that by displacing primary care visits, retail clinics could harm continuity of care.

In one survey, 26% of retail clinic patients said they would have sought care in an ER if a retail clinic was unavailable and 18% said they would have visited an urgent care center.

Studies have found most retail clinic customers do not have a primary care physician, meaning there is typically no care continuity or patient-physician relationship to disrupt. Retail clinics seem to serve a population that does not seek care in physician offices but might instead seek care at urgent care centers or hospital emergency rooms (ERs). In one survey, 26% of retail clinic patients said they would have sought care in an ER if a retail clinic was unavailable and 18% said they would have visited an urgent care center. Uninsured patients were significantly more likely to say they would visit an ER.

But for those who did visit a retail clinic and had a primary care physician, patients were not being referred back to their primary care physician following a clinic visit, indicating a lack of care continuity between retail clinics and primary care. Minimal primary care physician follow-up could also impact referral patterns, reducing downstream revenue opportunities for health systems and physician groups. To remedy this, stronger relationships between retail clinics and primary care physicians are needed.

Provider groups, such as the American Medical Association and the American Academy of Family Physicians, have also raised concerns about sub-standard care and overprescribing of antibiotics. However, the evidence suggests otherwise. A RAND study of 12 quality-of-care measures found retail clinics, physician offices, and urgent care centers had similar quality ratings. Researchers also found antibiotic prescribing is more guideline-concordant at retail clinics than in primary care offices or emergency departments.

Part III: How should traditional healthcare providers respond?

In the final part of this report, we’ll consider how traditional healthcare players should respond to the emerging role of retailers in the healthcare industry and explore different strategies that incumbent healthcare organizations can pursue to stay competitive. They are:

- Be open to partnerships with retail care

- Consider health system ownership models

- Adopt retail-like strategies to compete

The section will also discuss the importance of the customer experience.

Be open to partnerships with retail care

While retailers are disrupting healthcare delivery in the U.S., many healthcare organizations do not view retail clinics as a threat, but rather as an opportunity.

As retail clinics become an increasingly popular destination for consumers seeking healthcare services, it behooves traditional healthcare organizations to develop a relationship with them.

As retail clinics become an increasingly popular destination for consumers seeking healthcare services, it behooves traditional healthcare organizations to develop a relationship with them.

As a partner, retailers have several strengths: ease of access for the consumer, expertise in consumer engagement, proficiency in protocol-driven processes, robust consumer data analytics, and experience operating in a high-volume, low-cost environment. Retail clinics can also provide an important referral stream for primary care physicians and specialists – by partnering with the MinuteClinics and the Little Clinics of the world, traditional providers can capture these referral opportunities.

One of the highest-profile collaborations is Kaiser Permanente’s partnership with Target. Kaiser and Target offer retail clinics located in Target stores in Southern California, with care provided by Kaiser Permanente-employed clinical staff. These clinics, named Kaiser Permanente Clinic at Target, offer a broader range of services than are typically available at a retail clinic. Unlike most other Kaiser facilities, services at these retail clinics are available to Kaiser members and nonmembers.

For Kaiser, the value of these clinics lies in expanding access to the health system’s services and attracting new members by creating additional entry points to care in high-traffic retail locations — without significantly investing in infrastructure. For Target, the advantage is a well-established and trusted health system brand that can draw customers into its stores.

In other states, Target offers retail healthcare through CVS subsidiary MinuteClinic. CVS has a vast network of health systems and hospital partners, including the Cleveland Clinic, Dignity Health, and UMass Memorial Health Care, to support MinuteClinic consultations and referrals. In 2019, CVS MinuteClinics made 4 million referrals to primary care providers for patients with more complex care needs. And under the Cleveland Clinic partnership, the retailer and health system developed joint clinical programs to address high rates of chronic disease. Electronic health record (EHR) interoperability is a focal point of the partnership.

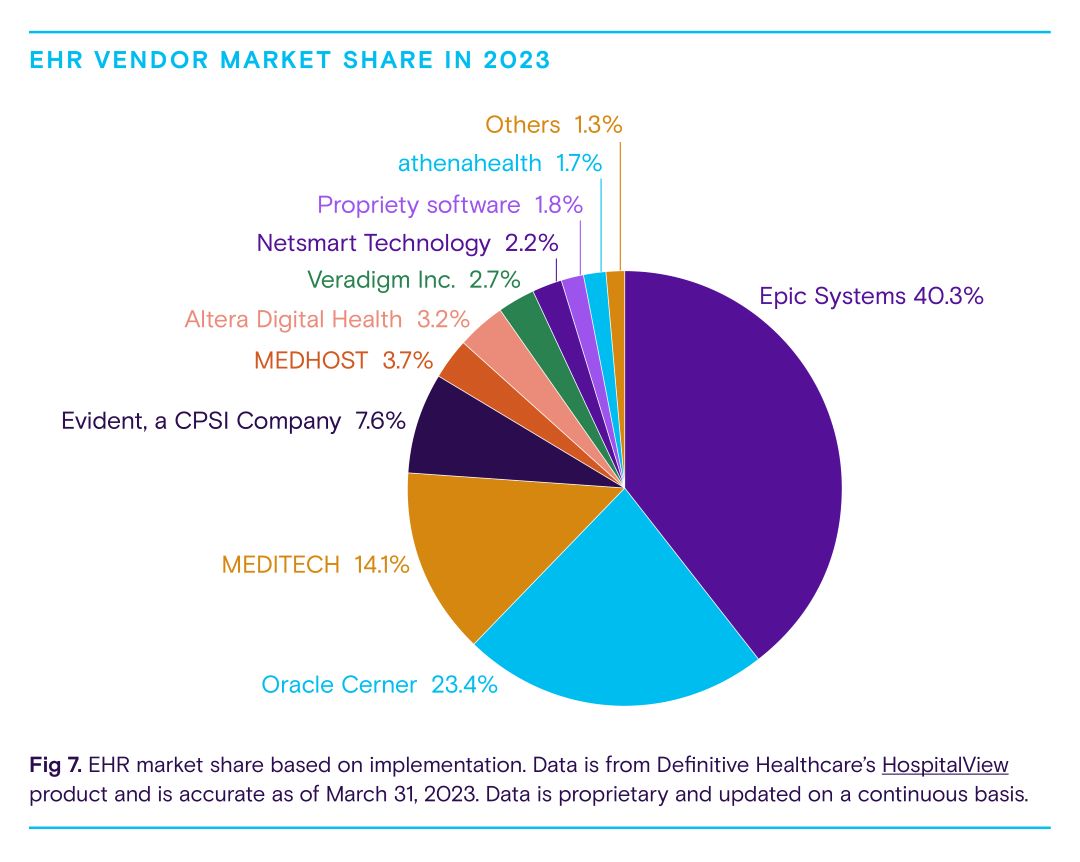

Regardless of how a partnership is structured, a robust information technology structure that supports care coordination between partners is essential to success. Health systems and hospitals are already well-resourced on this front—virtually all have electronic health record systems (EHR) in place. As shown above, nearly 80% of health systems and hospitals leverage three major EHR platforms: Epic Systems, Oracle Cerner, and MEDITECH. Retailers are also bolstering EHR infrastructure, much of which hails from Epic Systems, to advance EHR interoperability. To ensure consistent care, clinical protocols for conditions cared for at retail clinics should be embedded in electronic medical systems, alongside established referral processes to drive referrals to health system-affiliated primary care physicians.

Consider health system ownership models

Consolidation continues to take flight across the healthcare landscape as hospitals and health systems pursue mergers and acquisitions to strengthen their hold in certain markets, increase their scale, and expand their service offerings. A health system could acquire retail clinics to grow its ambulatory footprint and bring new access points to convenient care in certain markets. Healthcare systems have strong local brands, nurse practitioners to staff clinics, and physicians for oversight. They can also generate demand within the communities they serve based on trust. Any health system pursuing this route should have direct experience operating a retaillike clinic, such as community primary care clinics or employer worksite clinics.

Retailers that have built their own retail clinic operations but want to divest may consider selling these operations to a health system in their local market. In 2019, Walgreens shuttered about 160 in-house retail clinics to focus on health system partnerships and test new clinic models that target more complex health issues. The company shifted ownership and operations to several health systems, including Chicago-based Advocate Health Care and Atlanta-based Piedmont Healthcare. These health systems benefitted from already-established clinic spaces and full control over clinic operations.

Adopt retail-like strategies to compete

Patients today, many of whom grew up in the age of the internet, expect their healthcare experience to reflect the same level of convenience and accessibility as the rest of their digital lives. But many traditional healthcare providers have been slow to adapt and remain entrenched in outdated and inefficient service practices.

…retail clinics are tapping into the growing demand for easy access to care and leading the way towards more consumer-centric care options — and consumers are swarming in.

In contrast, retail clinics are tapping into the growing demand for easy access to care and leading the way towards more consumer-centric care options — and consumers are swarming in. By prioritizing the patient experience and offering frictionless care delivery, retailers are setting a new standard that traditional healthcare providers will need to meet to compete in today’s changing healthcare landscape. Traditional healthcare providers should take a cue from these new market entrants and embrace retail strategies to optimize their services and improve the patient experience.

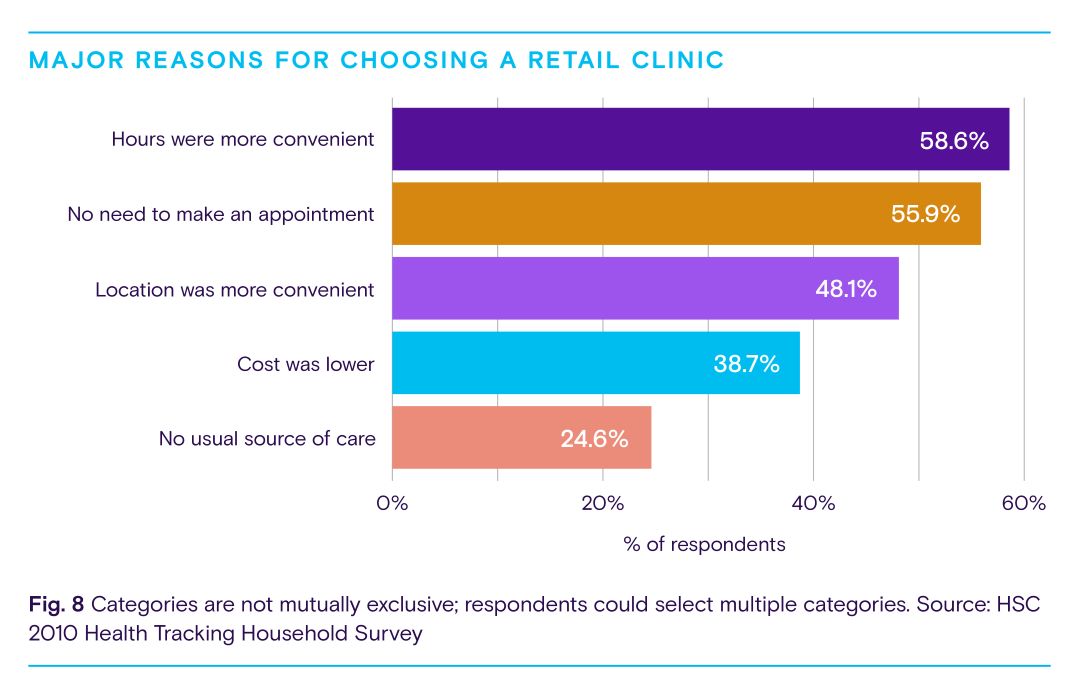

So, what does this look like in practice? It could mean offering extended hours and walk-in appointments to provide patients with the care they need, when they need it. A Robert Wood Johnson analysis found 59% of consumers chose a retail clinic over another primary care facility because the hours were more convenient, while 56% chose to use a retail clinic because there was no need to make an appointment. Fig. 8 below highlights other major reasons for choosing a retail clinic.

Another possible strategy is to employ online scheduling and check-in processes and offer telemedicine services. A survey by Kyruus found half of consumers said online booking was extremely or very important when selecting a provider, and 41% said virtual visit options were extremely or very important. According to the same survey, younger generations placed higher value on self-service options like online scheduling and virtual visits. For Gen Z, virtual visits (42%) were more important than online scheduling (29%) whereas Millennials weighed virtual visits (37%) and digital self-service scheduling (37%) in equal measure. By providing virtual visits, traditional providers can offer patients the convenience of retail clinics while maintaining the long-term, relationship-based care associated with traditional physician offices.

Finally, healthcare providers working to enhance consumer-centered healthcare to compete with retailers could implement patient-first billing strategies and greater cost transparency. Less than half of healthcare consumers understand their medical bills. What’s more, 51% of patients have been late on a medical bill, with many citing confusion as a reason why. Most patients want to understand their financial responsibility upfront and receive simpler medical bills. Healthcare providers can leverage technologies like electronic and text-based billing to deliver a more retail-like payment experience. They could also offer flexible payment options to boost patient loyalty.

Ultimately, the best patient experiences are those that put patients at the center of their care journey. Retailers know that convenience, affordability, and technology are all critical components to crafting patient experiences that engage consumers with their brands. By embracing these components of the retail clinic model, traditional healthcare organizations can preserve market share while delivering consumer-friendly healthcare that better serves patients.

Methodology

Information in this report was gathered and analyzed in March 2023. Data is from a variety of sources, including Definitive Healthcare products. All data points referenced are cited and linked throughout.

Healthcare provider information in the ClinicView and PhysicianView products are sourced from the NPI registry, Physician Compare, all-payor claims, and proprietary research. Our teams incorporate updates monthly and currently track more than 2.5 million healthcare providers.

Data from the Atlas All-Payor Claims product is sourced from multiple medical claims clearinghouses, revenue cycle management firms, and practice management software platforms in the U.S. and updated monthly. When possible, full calendar year 2022 is used.

Definitive Healthcare defines a retail clinic as a facility that provides non-emergency care to patients in a convenient retail setting (e.g., grocery store, pharmacy, etc.) These walk-in clinics are typically staffed by nurse practitioners and physician assistants and treat a range of minor injuries and illnesses. Physicians may be affiliated with a given retail clinic, but it is not required.