Last week, from November 6th to 8th, we were thrilled to attend the 2019 Staffing Industry Analysts (SIA) Healthcare Staffing Summit in Las Vegas. Presenting at booth #217, the Definitive Healthcare team had a blast meeting folks from all over the healthcare staffing industry (and a few of us even met celebrity chef Gordon Ramsay when visiting Hell’s Kitchen!).

We discussed a wide variety of topics with conference attendees, but in particular there are three big trends on the horizon for healthcare staffing: the increased need for Nurse Practitioners (NPs) and Physician Assistants (PAs), a growing number of VMS/MSP contracts, and technology implementations/upgrades.

1. Increase in nurse practitioners and physician assistants

As the physician shortage becomes more dire, many 2019 SIA Healthcare Staffing Summit attendees anticipate that there will be an increase in Physician Assistant (PA) and Nurse Practitioner (NP) candidates with increasingly complex procedure and diagnosis experience to fill in the gaps. In particular, many younger candidates entering the market may be more likely to avoid the high costs of medical school and opt to become NPs or PAs to save money.

Evidence supports that NPs are just as effective in primary care settings as physicians. Currently, only 21 states allow NPs to diagnose, treat and prescribe without some degree of supervision by a physician. We foresee that this number will grow in the coming years.

Traditionally, PAs have required supervision by physicians, but certain US states are starting to advocate for a larger scope of practice. Rhode Island, for instance, passed a bill in May that would allow physician assistants to be listed as primary-care providers and would relieve doctors of liability for PA’s work.

2. Growing number of MSP/VMS contracts

These days, hospitals are increasingly likely to use Vendor Management Systems (VMS) and Managed Service Providers (MSPs).

Managed Service Providers (MSPs) are outsourced agencies that triage applicants in place of hospital executives. With a growing provider shortage, many hospitals have come to rely entirely on MSPs to set up and manage their workforces.

Vendor Management Systems (VMS) are cloud-based software systems that help facilitate the process of worker recruitment and management. These systems store and collect metrics such as spend tracking, candidate information, and payroll and invoicing, to help companies better manage their workforce. A VMS is typically used to manage independent talent either by a company directly or by an MSP team on behalf of their client.

Given the increasing staffing shortage, many hospitals and care clinics are likely to invest in contracts with MSPs and VMSs (often together), and this trend is likely to continue to grow into 2020. For staffing agencies and healthcare IT companies, it’s more important than ever to know which hospitals are working through MSPs, and which ones are not. With VMS/MSPs as the sole gatekeepers for any independent staffing agency or healthcare IT company that wishes to do business with the hospital (and, with the hospital typically forbidden to work with individual vendors other than the ones working through the VMS/MSP) it’s important to determine which hospitals are free of an MSP contract, and therefore more likely to use your services. Or, it might be a good idea to start considering working with, or through, an MSP to bypass these longer-term contracts.

3. Technology implementations and upgrades

As hospitals and IDNs upgrade their systems, or implement new and different technology solutions, technology trainings are becoming increasingly essential. Provider organizations must consider whether they might need extra staffing help during technology training periods.

Currently, the healthcare market is saturated with many different types of technologies: EHR/EMR systems, patient portals, revenue and supply chain management technologies, health information management systems, and so many others. As mergers and acquisitions continue to disrupt the healthcare market, and hospitals continue to fold into IDNs, it’s increasingly challenging to understand where greenspace exists in the healthcare technology market. Further, it’s difficult for staffing agencies to understand the types of technologies that physicians and nurses will need training in, based on vendor market share. Software platforms like Definitive Healthcare can help healthcare IT companies and staffing agencies quickly find greenspace through prospective buyer scores, technology search functionality, RFPs and Definitive Conversations, and more. At the show, we asked two current clients what they liked best about the Definitive Healthcare platform:

“I use Definitive to make sure I’m prospecting to the companies I can make the most impact on. It gives me great information on financials, contingent labor spend, as well as all the executives that I want to reach out to,” said Jennifer Dorso, Director of Vendor Engagement at SimpliFI Managed Services.

“I utilize the Definitive platform in two really important ways, first and foremost you have the most reliable HCAHPS scores out there for me to measure how my hospitals are performing. And secondly, I love being able to see what contingent spend is for the hospitals I’m working with,” said Kathy Kerstens, Senior VP, Client Services, Travel Nurse Across America

Other facts and statistics we learned at SIA Healthcare Staffing Summit

- In 2027, healthcare spending is expected to reach 19.4 percent of GDP. The US will add 8.4 million new jobs between 2018 and 2028, with 40 percent in the healthcare space (3.4 million healthcare jobs).

- Healthcare staffing revenue is expected to grow by 4 percent both this year and next, reaching $18.1 billion by 2020, according to SIA projections.

- We will need 3.6 million nurses by 2030. The largest demographic shortages are expected in California, Texas, New Jersey and South Carolina.

- Home health aides will be the fastest-growing occupation between 2018 and 2028, growing by 38 percent, followed by physician assistants at 33 percent.

- The travel nursing market is poised to reach a record size of $5.8 billion in 2020. 56 percent of travel nursing spending comes through VMS/MSPs, and only 16 percent through standalone, as of 2018.

- Technology platforms are being developed to offer self-service for clinicians and clients — connecting those seeking jobs with those seeking additional staff.

- Escalating costs, tech disruption may exist, but robots will not replace surgeons in the coming years. However, robots could increase speed and precision of surgeries, and robots could handle more delivery and repetitive tasks. They are also adept at disinfecting.

See you next year in Houston for the 2020 SIA Healthcare Staffing Summit!

Learn more

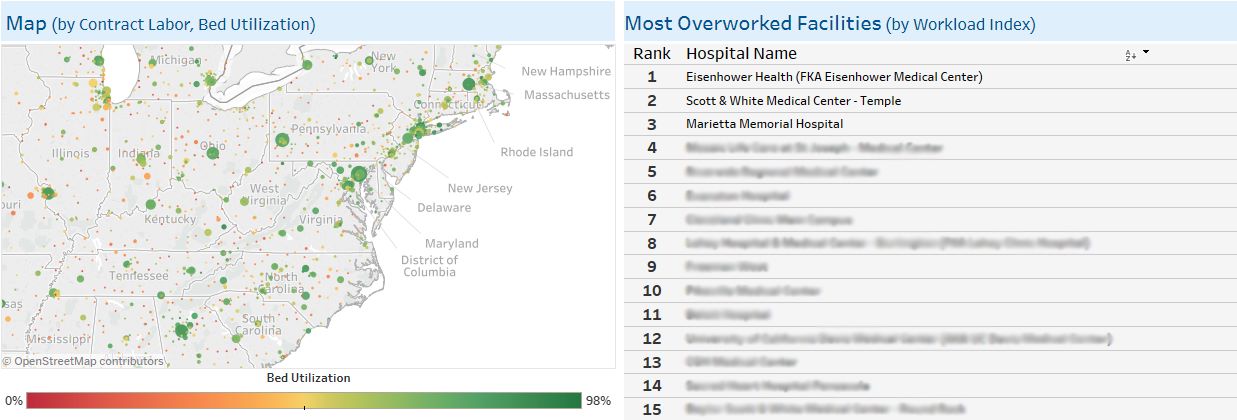

Looking for more information on how to streamline recruiting and physician placement? Sign up for a free trial to access Definitive Healthcare’s interactive Staffing and Recruiting Analytics dashboard. Identify the most overworked facilities by location and sort by affiliated physicians, predicted need for locum tenens providers, average bed utilization rates, and other filters.

Fig 2: Interactive Staffing and Recruiting Analytics dashboard from Definitive Healthcare. Image features a map of hospitals, color-coded by ratio of contract labor spending to bed utilization (left) and a list of the most overworked facilities by workload index (right).