The home healthcare industry is undergoing a rapid expansion, driven by an aging U.S. population. The senior citizen demographic (people 65 years or older) will reach 16.9% of the total U.S. population in 2020 and is expected to continue rising to reach 20.6% by 2030. Coinciding with this population shift is the growing necessity of care for the people who fall within the very age demographic most frequently suffering from chronic diseases.

In light of this shift, Definitive Healthcare surveyed 159 home healthcare agency (HHA) leaders in its first-ever Home Health Agency Study to uncover the most common services areas, lines of specialized care, and future plans for strategy and development. HHA executives and leaders across 38 different states responded to the online-based survey in October 2019. Here are the main findings:

1. A rise in telehealth technologies

Telehealth is gaining popularity in the long-term care market because it enables care teams to manage and monitor the health of chronically ill patient populations. These technologies can help prevent serious health issues and improve access to HHA services and other forms of care.

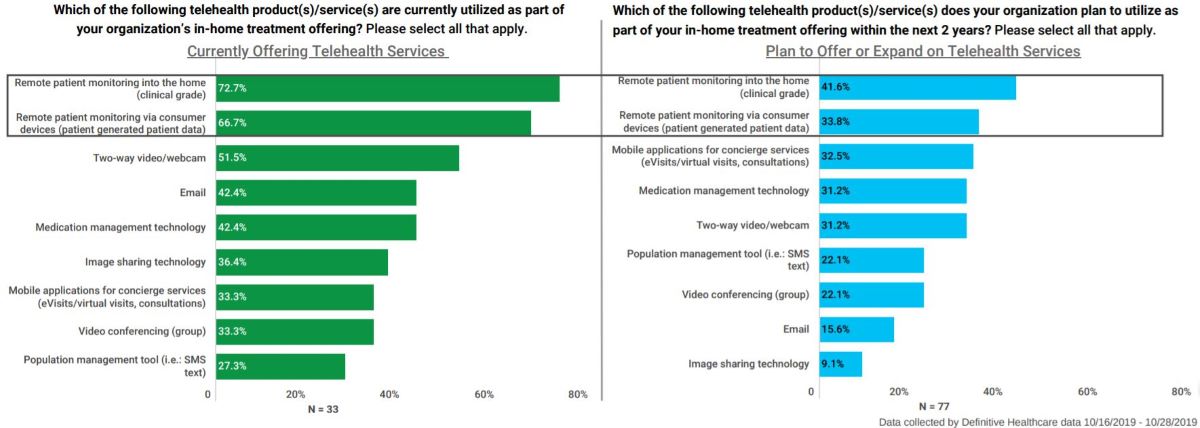

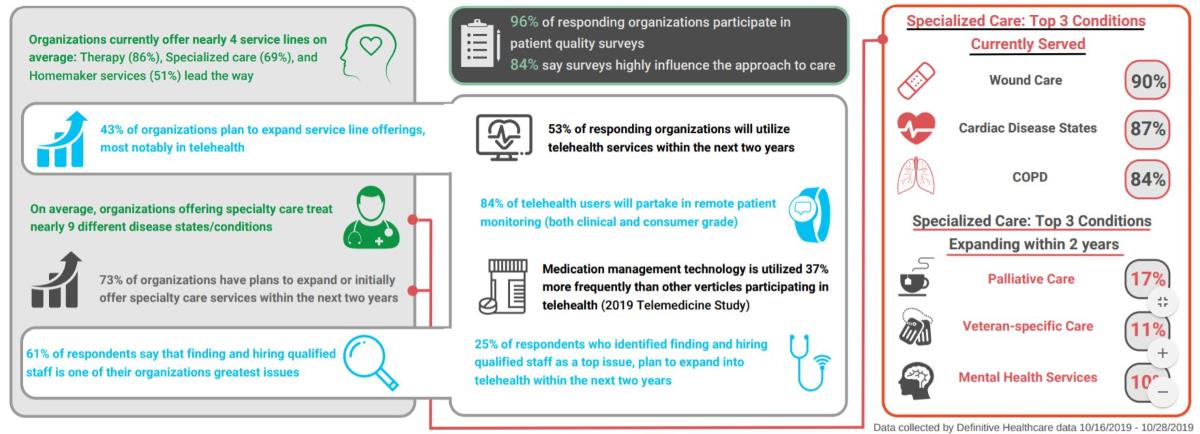

In the study, 24% of respondents stated that they are planning to expand their telehealth offerings within the next two years. Along with the nearly 21% of agencies currently utilizing telehealth technologies, a total 48% of respondents anticipated using telehealth offerings by 2021.

HHAs currently employ remote patient monitoring, and medication management technology at greater rates than both inpatient and outpatient organizations, based on another Definitive Healthcare study on telemedicine inpatient and outpatient usage. Most notably, two-way video/webcam technologies were used the most frequently across the three verticals.

Cost and ease-of-use may be the main contributors to the different strategic approaches for HHAs. Additionally, the HHA patient demographic trends older, suggesting a greater need for medication management and remote patient monitoring technologies.

Home health agency telehealth utilization: Current and future installations

Fig. 1 Definitive Healthcare’s Home Health Agency Study (2019), telemedicine utilization and future plans for installation

2. A need for specialized care

The Centers for Medicare and Medicaid Services (CMS) announced in 2019 that, starting in 2020, Medicare Advantage plans would further expand coverage for patients with chronic diseases or conditions. Per the U.S. Bureau of Labor Statistics (BLS), the home healthcare industry is forecasting a 36% employment growth rate by the year 2028, adding an estimated 1 million jobs in the process

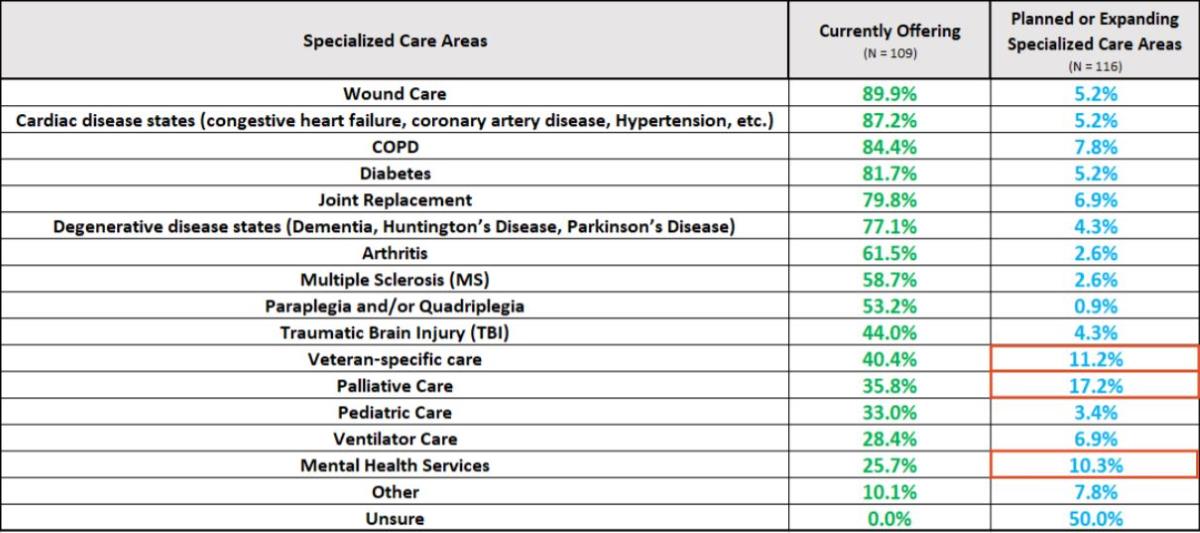

Knowing this, it is of little surprise that 43% of respondents from the 2019 Home Health Agency Study planned to expand their service offerings within the next two years. This includes specialized care service areas, which focus on the treatments of specific (often chronic) disease states and conditions.

Within two years, 73% of responding organizations indicated that they would either expand or initially enter into specialized care. Based on the study, disease states or conditions showing the greatest rate of expansion in the immediate future were palliative care, veteran-specific care, and mental health services.

Home health agency specialized care offerings

Fig. 2 Definitive Healthcare Home Health Agency Study (2019): specialty care offerings and plans for future installations

3. Staffing and profitability will become increasingly challenging

As the home health agency market continues to grow and expand, it is not surprising that the need for finding and hiring qualified staff tops the list of greatest challenges. Over 60% of organizations identified the issue as a challenge for their organization—a 20% difference from the next closest top challenge: profitability.

With the baby boomer generation continuing to phase into the age demographic which suffers the most from chronic conditions and diseases, the need for acquiring qualified staff is likely to remain a top issue in the home health agency industry.

However, rising usage of telehealth platforms could provide some relief from the strain of healthcare staffing shortages by connecting patients to remote providers and keeping patients in network.

2019 HHA study overview

Fig. 3 A graphic overview of the Definitive Healthcare Home Health Agency Study (2019)

Learn more

Definitive Healthcare’s platform offers insight into over 16,000 U.S. home health agencies, including contact information of HHA executives and leadership, quality metrics, claims broken down by HHRG codes, affiliations with physician groups, ambulatory surgery centers and other institutions, and HHA financial performance data. With the Definitive Healthcare platform, users can:

- Understand the continuum of care: Compare referrals to and from HHAs to understand relationships with hospitals. Look up the percentage of referrals originating from a specific hospital, and whether that hospital is part of a larger IDN.

- Measure quality of care: Access HCAHPS star ratings on an HHA’s overall care quality. See whether patients got better at bathing or getting in and out of bed, as well as how often patients had less pain when moving around.

- Analyze care leakage: Examine cases where patients of one HHA seek treatment at other HHAs for specialized treatments. Find leakage by facility or diagnosis code.

- Review payor mix analyses: Identify the percentage of payments originating from Medicare and Medicaid as well as commercial payors such as TRICARE, Aetna, and BlueCross BlueShield.

Start your free trial today.